Last week, Buy Now Pay Later (BNPL) giant Klarna announced a global partnership with Uber, allowing customers in the US, Germany, and Sweden to ride a taxi or feast on Uber Eats delivery by promising they'll pay it back later, at a time that coincides with their monthly salary cycle.

This announcement reflects a growing global consumer base that seeks access to immediately available alternative credit, with zero interest and embedded protections to guard against accumulating debt.

Over 35% of consumers in the UK and US chose to use a BNPL solution at least once last year.

In this week's edition of The Praxis Times, we'll take a closer look at what makes this alternative access to credit so appealing, from both a consumer's and a merchant's perspective.

What Exactly is BNPL?

BNPL is a form of short-term financing that gives consumers access to immediate credit without having to pass long credit checks. These solutions typically do not charge interest and won't generally affect somebody's credit score unless they are late to make payments - usually spread over 4 installments - or fail to pay altogether.

This financing style originates not from traditional banks but from fintech and paytech companies like Klarna, PayPal, and even retail giants like Walmart, which just this week announced a startup company it has a majority stake in called 'One' will offer BNPL options to customers purchasing expensive products in-store.

But how is this different from a credit card?

Both BNPL and credit card solutions let consumers pay for a product or service over a period of time, but one of the main differences is that each BNPL purchase represents a separate credit agreement, and the limit of how much you can borrow tends to be much less than that on a credit card.

Klarna also restricts the use of their services if a payment is missed to stop debt from building up.

Other key differences include how quickly you can access a BNPL solution compared to registering for a thoroughly means-tested credit card, the timeline of repayment plans, minimum repayment options of credit cards vs. late payment fees of BNPL, and how this all affects somebody's credit score.

For a more complete comparison between the two, this Forbes article goes much more in-depth, although the difference between traditional access to credit vs. these newer alternative methods is increasingly becoming more complex.

Take Klarna's newest card, for example, which competes against the credit card market by offering consumers access to credit via a card that has the option to pay a monthly statement in full at zero interest. In this sense, Klarna’s blending these two worlds of credit together.

The Consumer Advantage

The BNPL model is especially attractive to younger demographics who prioritize budget management. For instance, consider a consumer eyeing the latest high-end smartphone priced over $1,000. While they may have the cash on hand, opting for an interest-free installment plan through a BNPL service makes the purchase more manageable over time.

This is not just about easing financial strain; it's about smart financial management that aligns with modern consumers' lifestyles and values.

The Merchant's Perspective

From the merchant's viewpoint, BNPL isn't just another payment option but also a conversion strategy. Merchants offering BNPL can expect to see increased average order values and improved conversion rates.

This is because the option to spread payments makes higher-priced items more accessible to a broader audience. Additionally, integrating BNPL solutions at online and physical points of sale often results in reduced cart abandonment rates.

Strategic Integration Challenges

Integrating BNPL solutions into existing payment systems isn't trivial. It involves navigating technical complexities and aligning with various provider specifications. Merchants must consider:

- Transaction Fees: BNPL providers typically charge merchants a fee ranging from 2% to 8%. These fees vary depending on the provider's business model, the interest-free duration offered, and other factors.

- Technical Requirements: Seamless integration of BNPL services into existing payment infrastructures requires robust backend support. Merchants need to ensure that their systems can handle additional payment tracking and reconciliation processes.

- Consumer Trust and Security: Customers don't like to borrow money from providers they haven't heard of before. For this reason, providers like PayPal, Klarna, Affirm, and even Apple's Pay Later solution benefit from brand recognition. Incorporating these providers into checkouts has a big impact.

It's important to highlight that when a customer chooses a BNPL solution, the provider pays the merchant the full amount of what is owed there and then. It's next up to the customer to pay back the provider, who has charged a service fee to the merchant.

Expanding Beyond B2C Payments

These solutions are not limited to business-to-customer (B2C) transactions and are making strides in the business-to-business (B2B) arena as well, where more than 50% of transactions are already facilitated through pre-agreed payment terms rather than one-off lump sums.

For businesses, accessing short-term credit through traditional credit institutions can be time-consuming, and the BNPL solution is a promising alternative, although not yet mainstream.

Key Takeaways

For merchants, deciding whether to adopt BNPL methods in their payment operations still widely depends on the industry they operate in, the age and location of their target customer, and fundamentally, whether it is even possible.

What is clear, however, is that this form of payment method is increasingly sought after by consumers at the checkout, and offering them the ability to buy now, and pay later, is sometimes what will lead to a successful sale or not.

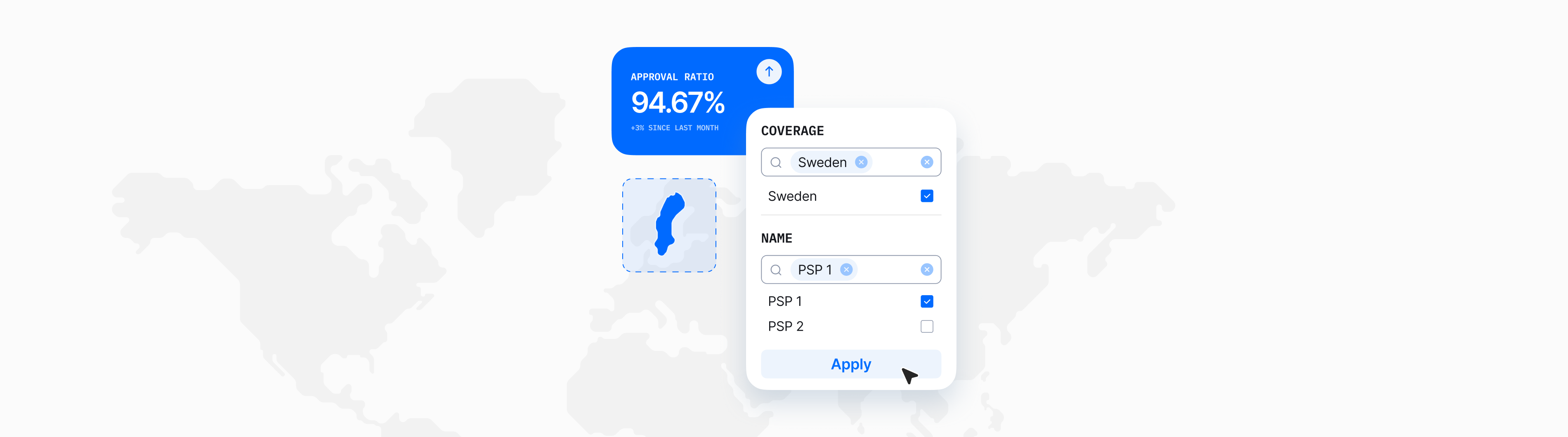

As a payment technology firm with its own Payment Orchestration Platform, Praxis Tech helps merchants integrate over a thousand alternative payment solutions into their checkouts. Connected to more than five hundred Payment Service Providers worldwide, we make it easy for businesses to expand their payment options and cater to diverse customer preferences. Contact us to learn more.