There are enough credit cards in circulation to span the Earth more than 3.5 times. And yet, businesses still face issues with CC deposits. Physical credit cards are the same size all over the world, but credit card deposits are no longer one size fits all.

Credit cards feel like they have been around forever, but they have only really become popular in the last decade – single women couldn’t even get credit cards until 1974!

Why You Should Be Accepting Credit Card Deposits

There are a number of reasons as to why your business should be accepting credit card payments, with the first reason being that they are a popular form of payment. Customers expect to be able to pay with credit cards when making a deposit.

Once upon a time, New York restaurants were the only place to accept credit cards. Now, almost everyone who has access to the internet has a credit card. It’s the most widely used payment option in the world!

Not only are credit cards convenient for customers, but for merchants too. With the help of payment gateways, it’s easier than ever to transfer money between your merchant account and a payment processor that authorizes CC payments

The world of online payments is constantly evolving, with new payment methods becoming available, credit card payments will always remain a constant. They make depositing quick and easy for clients through a solution they already know and trust, increasing revenue in the process.

What Should You Be Aware of When Accepting Credit Cards?

Credit cards still have a high decline rate, sometimes due to issues out of the merchant’s control. Here are the main reasons credit card payments can go wrong:

- Customer’s bank declined the payment directly

- The card details were entered incorrectly

- 3DS declines due to wrong OTP entered

A large number of declines can also be due to suspected fraud, being the largest and main concern for credit card deposits. Suspected fraud can be triggered for many reasons, so payment processors with extra security layers are vital for businesses who accept card deposits.

Lastly, credit card fees are known to be high. Credit Card Payment Solutions have the highest fee rate over any other payment method. Don’t let this drive you away from accepting card deposits, though, as there are ways to make these fees work for you.

Praxis Can Help!

Finding the right credit card processor to fit your business needs can be a long process. Every PSP has their own list of blocked/ allowed countries, min/ max deposits limits, and we are here to make sure you find the right fit.

Finding the right PSP for you can take hours of your valued time, but our team of professionals have done all the research, so you don’t have to! We can help integrate a solution that fits all your business needs, with multiple payment options available. Integration has never been easier as we are with you every step of the way!

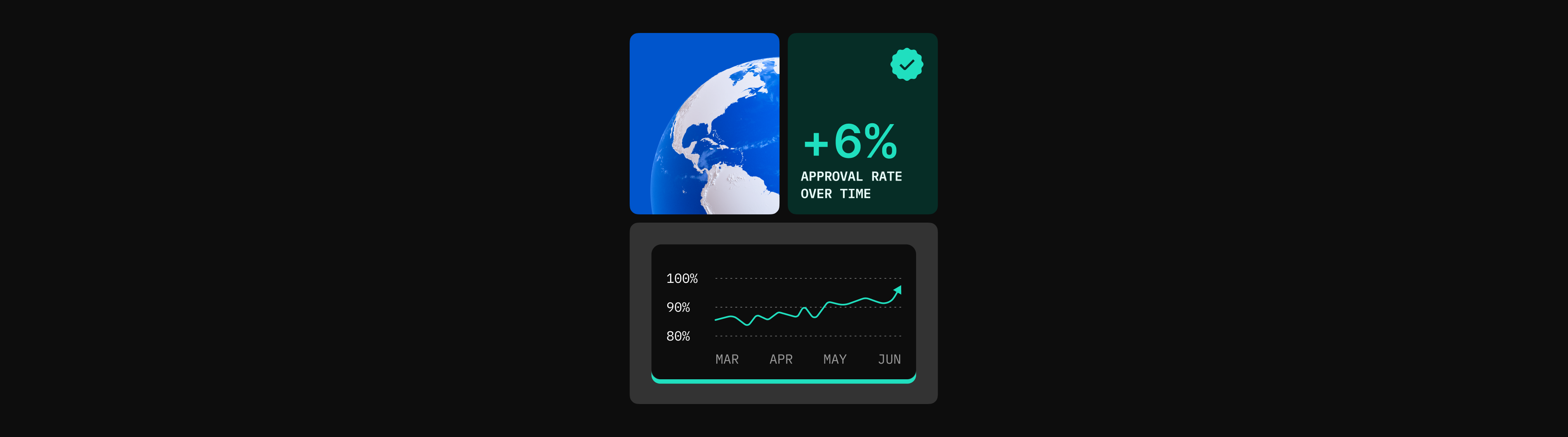

Fee management, conversion rates, fraud, and even unnecessary declines are managed correctly from one single dashboard. Smart routing allows client deposits to be routed to the best possible solution based on country, currency, and card type! Automating this process has proven to save countless unnecessary declines, merchants time, and client complaints.

With Praxis, accepting credit card deposits is made simple. We do the heavy lifting, and you get to accept credit card deposits and increase ROI!