Payment declined. That is one phrase all customers hate to see, no matter the reason. In 2019, customers whose payments were declined took their business elsewhere, accounting for $13 billion. Many gave up on the purchase entirely, costing merchants, acquirers, issues, and processors $7.6 billion.

Inevitable? Not anymore! Smart routing technology can save the day by bringing you more efficiency and savings.

What is smart routing?

Smart payment routing tech sends transactions through the channel where they’re most likely to be approved. It’s so smart it can even examine a failed transaction (AKA failover transactions) and reroute it to another Credit Card (CC) gateway via a process called cascading.

Common issues that result in declined payments are:

- Incorrect card details entered

- Gateway for transaction down

- Anti-fraud detection identifies a risky transaction

The main consequences of payment problems are unhappy customers and lost sales. Your customers may even fully abandon their transactions with you for the foreseeable future if they think it’s a problem on your end.

How does smart routing help small businesses?

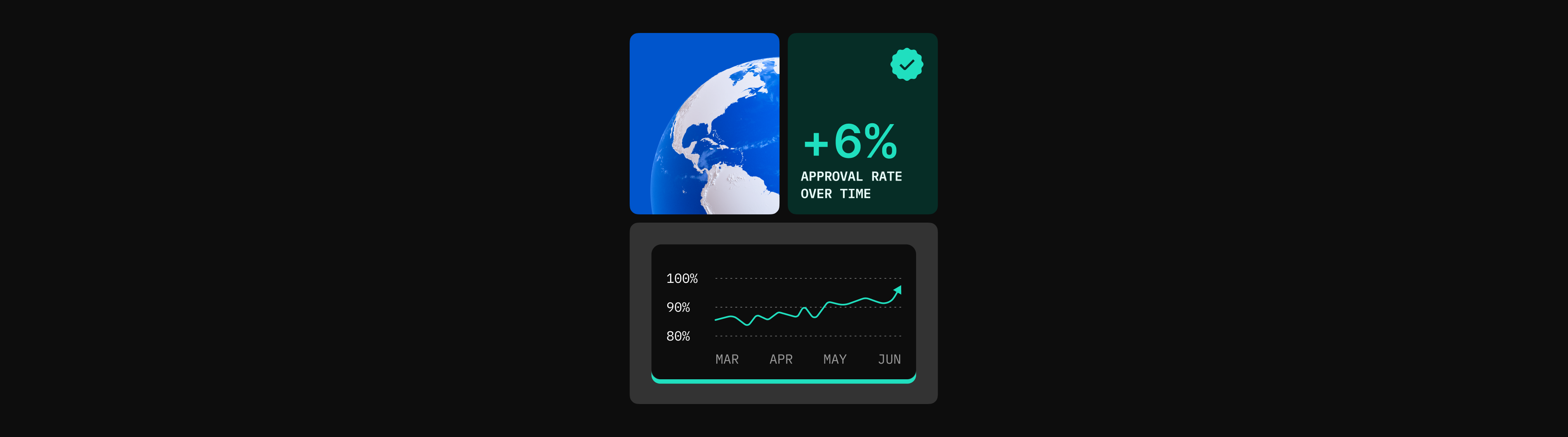

Small businesses can really benefit from smart routing because they usually only have a single CC gateway and processor. When expanding services to the international market, businesses need to ensure their gateway covers these new countries of operation. There’s a lot to take into account: currencies, payment methods, card types, and even issuing banks.

Each transaction needs to be directed to the right gateway to prevent technical issues and declined payments.

How does smart routing benefit large businesses?

Large businesses have large sales sizes and impressive geographical sway. Unfortunately, this means they need to accommodate for more varied customer needs, such as multiple gateways and processors for payment. Because there is more than one processor, international enterprise payment systems become harder to navigate.

Smart routing facilitates transactions so that customers can pay in the way they want to pay securely and easily.

Smart routing prevents failures

International customer needs aren’t the only problem smart routing can resolve. Advanced smart routing can help businesses that need to deal with large sales volumes, which may occur during holidays like Black Friday or Cyber Monday. E-commerces often run into technical failures when there is high volume, which can be devastating since there are no brick and mortar alternatives for them. Luckily, smart routing helps reroute transactions so that there will be fewer technical difficulties and more successful transactions, allowing merchants to reap the full revenue they should be getting from sales.

Benefits of smart routing

Higher success rates

Smart routing tech helps you snag those higher approval rates. It can also help you reduce the number of frustrating false declines. Having a high approval ratio goes a long way in raising the success rate of your business.

Lower transaction costs

Transaction costs can add up over time, presenting a less visible but definitely significant expense. For businesses that make many transactions as opposed to fewer but larger ones, frequent transactions can make a dent in your budget. Currency exchange costs are not fun for merchants either.

One great benefit of smart routing is that you can optimize your routing so that it automatically finds the lowest-cost configuration. This will lower your transaction costs, which is much more cost-effective for merchants who sell high volumes of products.

Improved customer satisfaction

Customers remember when a transaction fails. It makes their shopping experience feel like a waste of time, and they often end up abandoning the cart if the transaction does not go through the first time. To increase the chances of a seamless customer journey, especially if said journey is done overseas or across borders, you need smart routing.

The more satisfied your customers are with their checkout and payment experience, the more likely they are to return in the future. Let smart routing prevent customers from holding grudges over failed transactions and declined payments!

Solves gateway downtime

Before smart routing, gateway downtimes could waste a lot of time and lose businesses money. With the cascading that smart routing does, you gain a sort of insurance in case a gateway is down. Transactions can be swiftly rerouted to a different, functional gateway.

Makes you more competitive

A lot of e-commerces and modern businesses are opting for more advanced and optimized payment options. This means that if your payment process isn’t as convenient and painless as customers expect, you may stick out like a sore thumb. On the other hand, if you have smart routing to prevent failed transactions, especially during high-traffic events like Black Friday, customers will appreciate the seamless transactions.

What causes failed transactions?

Failed payments may occur because of technical issues, financial issues on the customer’s end, and risk assessment problems (in which case anti-fraud rules and authentication issues kick in to cause payment errors or declines).

Compared to other kinds of problems, technical issues are often the most complex to solve and understand. It often takes longer to resolve.

When you break down a single transaction, it has many enmeshed parts, including the payment processor, acquirer, and issuing bank. If any single entity fails, the online payment will not go through properly.

Intelligent routing is one of the best ways to decrease the negative impact of failed payments.

How can we help?

Praxis offers the latest, advanced smart routing for card payments based on:

- Country

- Currency

- Card type

Whether you’re looking to break into the international market or you just want to resolve current transaction issues, Praxis can help.

Our smart routing allows you to set up routing rules as desired. One central dashboard exists to facilitate all your payment gateways. For your convenience and freedom, you can choose to perform this process yourself – or you can let our CSM and Support team do it for you. Reach out to us today!