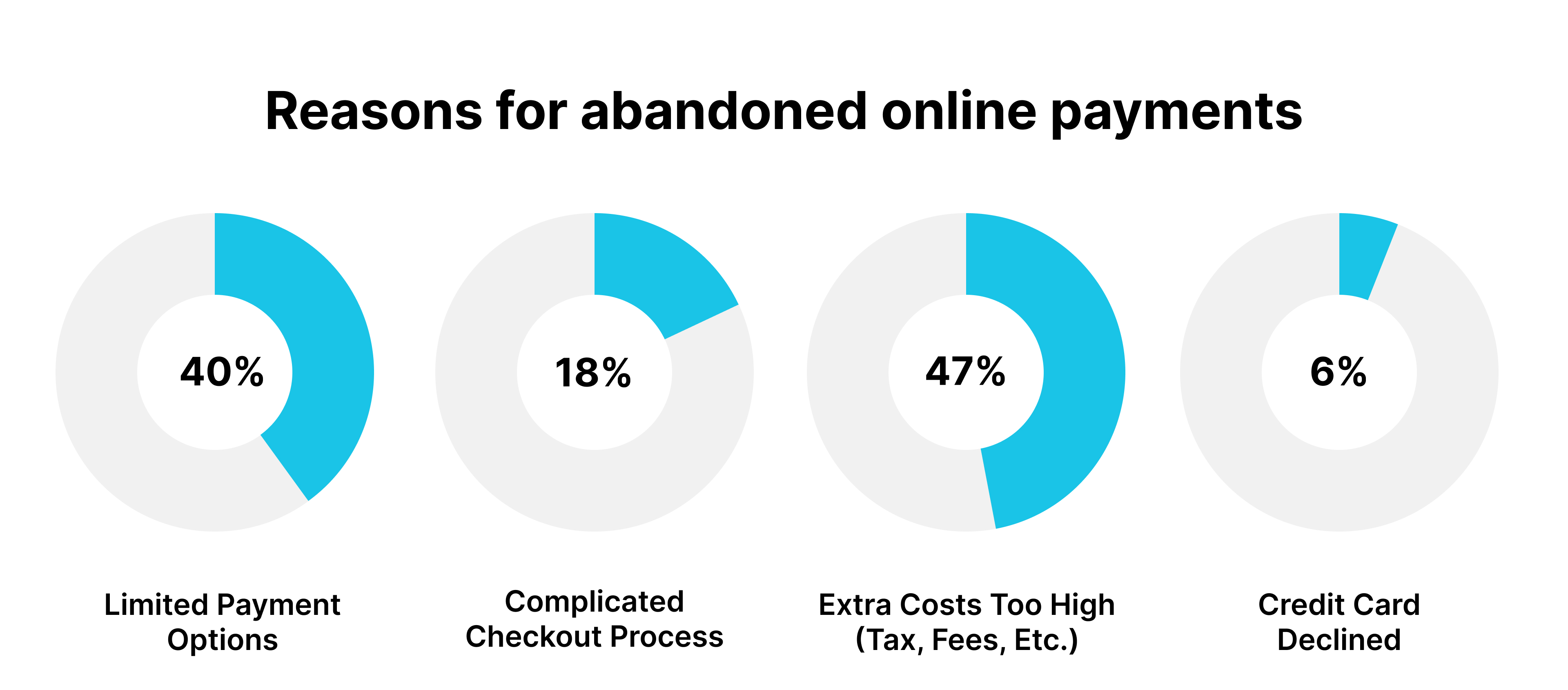

How often have you gone to make an online payment only to close the Chrome tab and leave the transaction unfinished? Unfortunately, this happens more often than you’d think, costing businesses sales. Nearly 3 in 5 of us abandoned some type of transaction last year, whether paying a bill, booking travel, or signing up for a subscription. This issue impacts a wide range of industries, from software services to finance and online gaming.

Limited payment options cause 40% of abandoned transactions, with security concerns leading to 29% more. Worse yet, 18% of would-be customers abandon because the process takes too long or feels too complicated - which is a shame, as this can be easily avoided.

This article lists the steps businesses are taking to minimize abandoned transactions by improving their payment and retention experiences.

Everyone appreciates a good looking & functional checkout experience

If you’re a business that is experiencing high levels of transaction abandonment, your first line of defense is incorporating a smooth, good-looking, and frictionless user experience into your checkout forms. These are the principles to keep in mind:

- Minimize steps to avoid a never-ending checkout experience that feels like it is taking forever.

- Offer geo-relevant local payment methods and let your customers pay however they like.

- If a customer clicks ‘Pay Now’ but something technically goes wrong, offer immediate alternative solutions.

- If they do abandon anyway, don’t let it be the end. Re-engage every lost sale.

Source: Baymard Research (2023 US Survey of 2,219 adults) and Statista (2022 Survey of 9,004 adults)

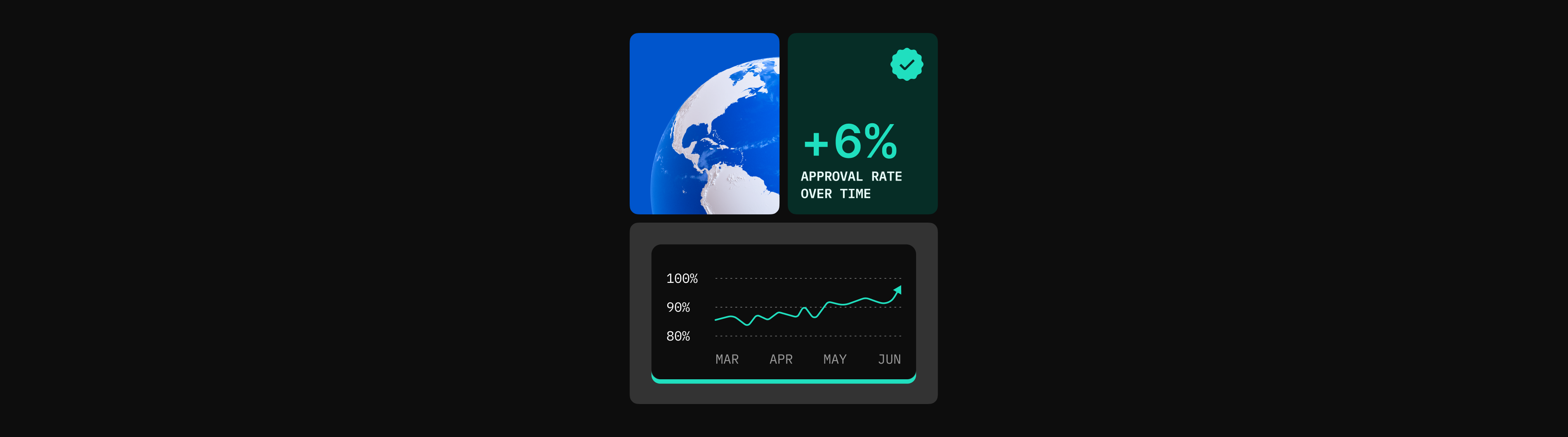

Most payment methods are local, not global.

Have you ever tried to complete a payment online, only to find out the business doesn’t accept Apple Pay, Google Pay, or PayPal, and decide to abandon ship? The same can be said for having the option to pay with PIX in Brazil (which accounts for over 40% of online payments in the country), or iDEAL in the Netherlands. Of course, however, you wouldn’t offer a German customer the option to pay in WeChat pay, while you definitely should offer this to your Chinese customers.

The world is very diverse in its cultures and ways of life, but also in popular payment methods.

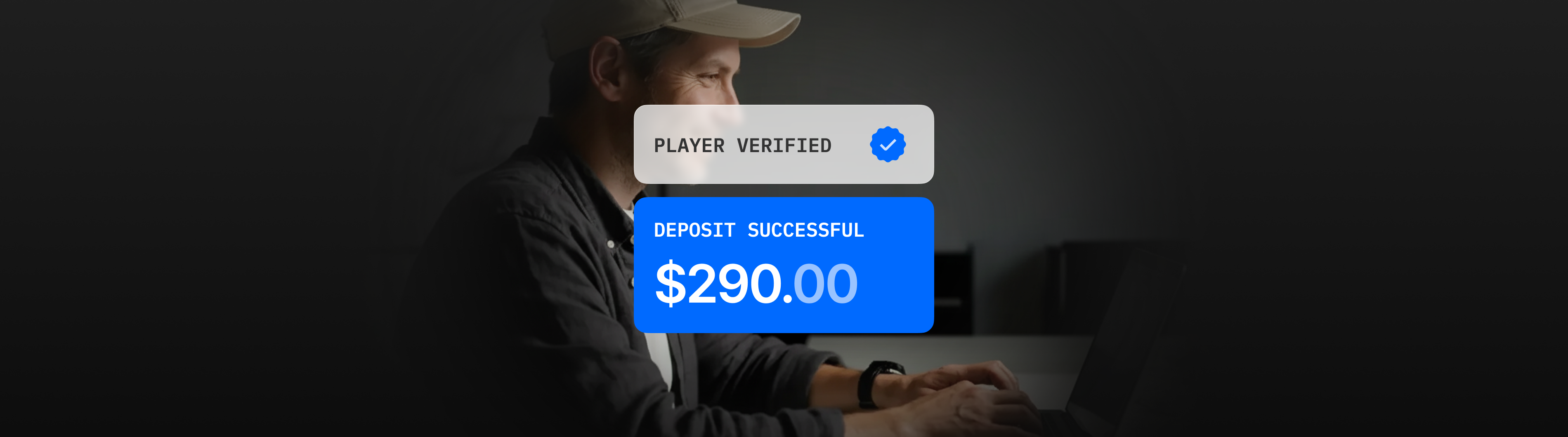

Having geo-relevant local payment method options is fundamental to successful sales for companies that cater to a global audience. Research shows that two-thirds of consumers chose to make an online purchase at a specific merchant instead of another because that business accepted their chosen payment method last year, according to Pymnts Intelligence. Of course, the same can be said for the everyday preference to pay in your local currency.

We’ve previously explored the most popular ways consumers like to pay online in our alternative payments blog series, which lists the most in-demand payment options in Asia, Africa, South America, and even the single-currency but still definitely diverse Eurozone.

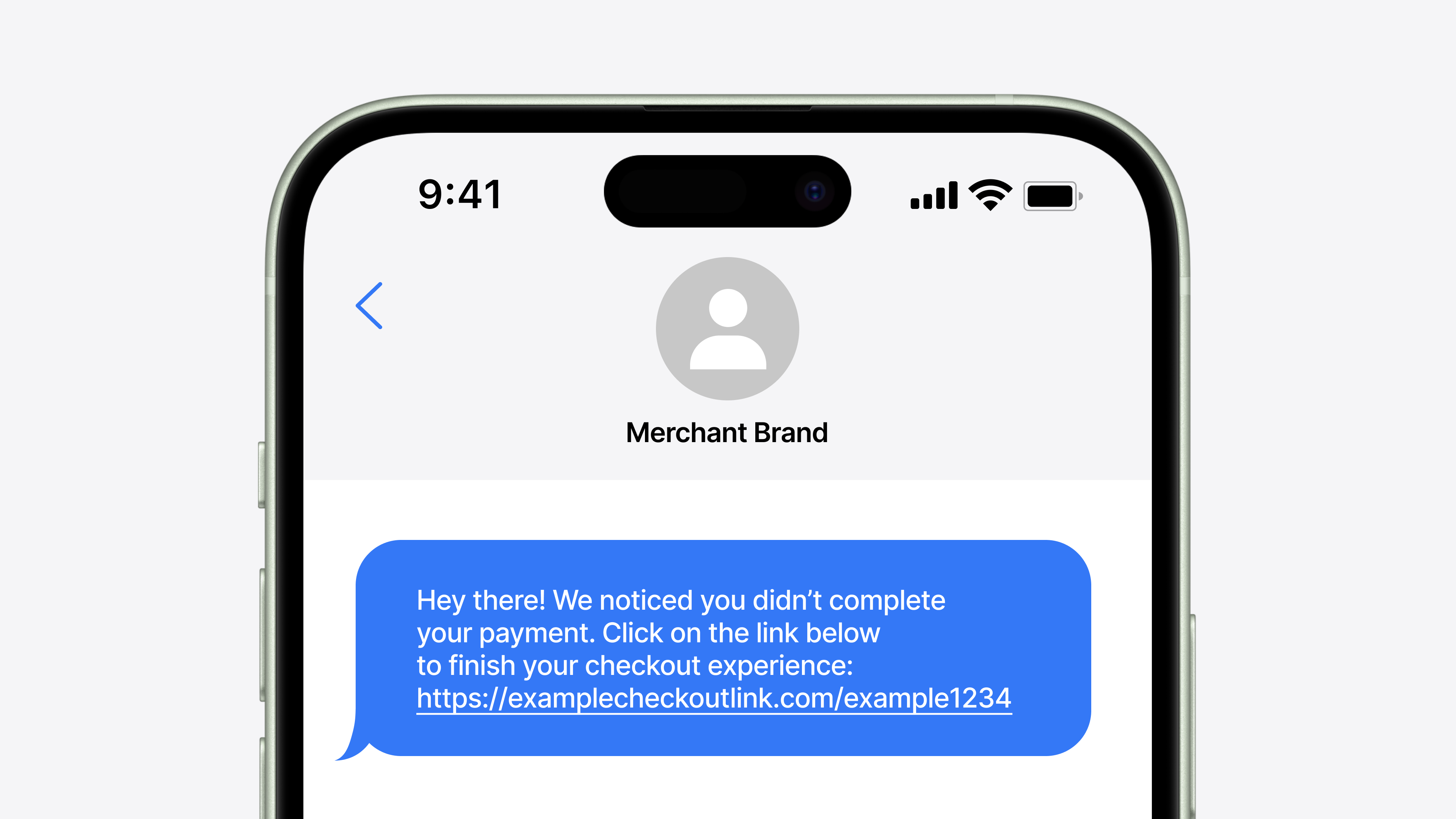

Re-engaging the Abandoners: Don’t Let Them Slip Away

Even with all the above efforts, some customers might still abandon their checkout journey. This is where the advanced re-engagement features of payment orchestration platforms come into play. Platforms like Praxis Tech offer functionalities like our Abandoned Transaction Events feature, which alerts merchants about early exits and allows them to send personalized reminders via push notifications, emails, or text messages.

These reminders can include direct links back to the checkout page or a convenient QR Code, making it easy for customers to pick up where they left off. By proactively re-engaging potential customers, businesses demonstrate responsiveness and increase the chances of converting them into satisfied customers.

Everything else customers like to see.

In summary, there are many factors merchants can implement to minimize abandoned transactions and ensure customers complete their intended purchases:

- Offer a streamlined, intuitive checkout process that is easy to navigate on all devices.

- Provide the flexibility of preferred local payment methods and currencies.

- Incorporate robust technical solutions on the backend to route transactions optimally for speed, security, and reduced cross-border costs.

- Re-engage lost sales proactively when transactions do fail to complete.

The key principles are convenience, choice, and reliability.

By understanding regional customer preferences, smoothly guiding buyers through purchase or deposit workflows, and leveraging tools to maximize successful payments, businesses can significantly reduce abandoned checkouts.

For merchants looking to incorporate these solutions into their payment operations, Praxis Tech offers an end-to-end payment orchestration platform that links merchants to a wide range of global payment processors and provides advanced features for managing both front and back-end transaction flows. Get in touch to learn more.