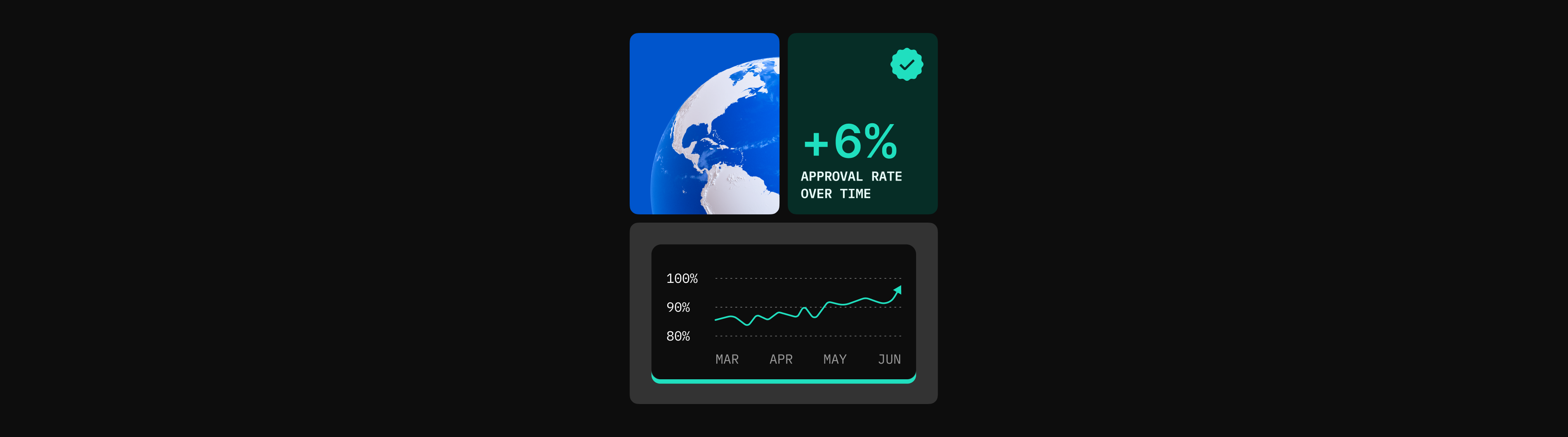

As we continue with our series of articles exploring Alternative Payment Methods (APMs) around the world, there is a definite trend we would like to focus on today: cash-based payment methods and the unexpected appeal they have across the globe, for various reasons.

In this day and age, it’s easy to think that the world is going cashless. From mobile payments and embedded finance, to open banking, the trends suggest that cash payments are about to become obsolete, right? Wrong!

In fact, cash-based systems continue to hold a significant place in the global economy. These include payment vouchers or codes that can be purchased with cash and used for online payments. While the reasons for their popularity vary across regions, they remain a preferred choice for millions of consumers worldwide. For a number of reasons, millions of consumers worldwide still see cash as king. As a result, the prevalence of digital transactions has led to cash-based APM solutions, such as PaySafe, CashU, Pagofacil, Rapipago, Boleto, and many more.

This information will be crucial in building your “client personas” for local markets, as well as narrowing down on your preferred localized payment solutions. Be sure to talk to our Payment Optimization Managers to figure out what cash-based APMs would be best for your business and target markets.

Why do consumers continue to rely on cash-based payment methods? Here are a couple of reasons:

Privacy and Anonymity

In many parts of Europe, particularly in countries like Germany and Switzerland, cash is favored due to privacy concerns. The culture of financial privacy is deeply ingrained, and cash transactions provide individuals with a sense of anonymity in their financial dealings. As a result, payment solutions like PaySafe hold a sizeable market share.

Convenience

For a considerable portion of the global population, especially in developing countries of Latin America, as well as India and a number of African countries, cash remains the most accessible and convenient payment method. In rural areas with limited access to banking infrastructure, ATMs, or internet services, cash transactions are often the only viable option. Moreover, cash payments are often preferred and prevalent due to the simplicity of cash exchanges, requiring no special technology or knowledge.

Market Access for the Unbanked Population

In regions with a significant unbanked or underbanked population, such as parts of Africa and Southeast Asia, cash serves as a bridge to financial inclusion. People without access to banking services can participate in economic activities, make purchases, and pay bills using physical currency. In countries like Kenya and Ghana, cash payments enable marginalized communities to engage in the marketplace.

Cultural and Traditional Factors

Cultural norms and traditions also play a role in the popularity of cash payments. In many Asian countries cash gifts are a part of celebrations and ceremonies (think China’s “red envelopes”, traditionally given for the New Year), which still ingrains the use of physical currency in daily life. These customs contribute to the enduring relevance of cash-based systems, even alongside other, more “modern” payment methods. Check out our article about Asia’s popular APMs here.

Security Concerns

Some individuals, especially older generations, prefer cash due to security concerns associated with digital transactions. In Latin American countries like Argentina and Colombia, security fears drive people to prefer physical cash as it provides a tangible (although misleading) sense of security, remaining physically in their possession. Another security-related factor is emergency preparedness, in situations where natural disasters or power outages when digital payment methods may be unavailable at all times. In countries prone to such incidents, including parts of Southeast Asia and Central America, having physical currency on hand ensures that people can purchase essential goods and services even in challenging circumstances.

At Praxis, our network spans more than 1000 alternative payment methods, popular worldwide. Contact us to learn more.