We use embedded finance every day and it’s already transforming the way we all transact and interact with financial services. You may have blinked and missed it, but you interact with embedded finance technology every time you pay for a taxi via an app, use store credit to order a coffee on your phone, or add travel insurance to your cart when booking your holiday abroad. Embedded finance has completed its transition from being an industry buzzword to powering your favorite online businesses and is reshaping both B2C and B2B landscapes. It promises to be a transformative force in supporting businesses to gain a competitive edge through enhancing their offerings and meeting the ever-increasing demands of consumers to have financial services delivered at the point of need.

Defining the Landscape: Unveiling the Layers

At its core, embedded finance introduces financial services where they’ve traditionally been absent, enhancing user experiences and boosting business capabilities. This integration enriches user experiences and enhances business offerings. Distinguishing between the varying concepts is important:

- Embedded Finance: Relates to the seamless integration of financial services into non-financial platforms or customer experiences, elevating the user journey and broadening the products and services offered by non-financial businesses.

- Banking as a Service (BaaS): This term refers to the connection between traditional banks and newer fintech companies, enabling the latter to leverage the established infrastructure of banks to deliver embedded financial services.

- Open Banking: Although not directly connected to embedded finance, open baking facilitates the exchange of financial data between banks, financial institutions, and third-party entities, contributing to the diversified fintech ecosystem.

Who’s Leading on Embedded Finance?

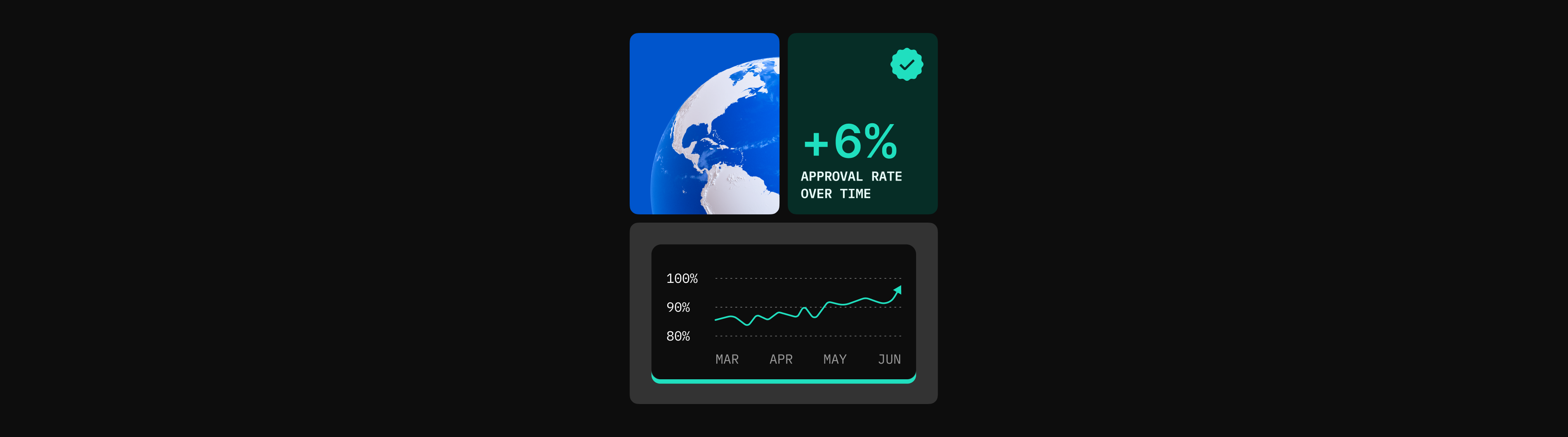

The embedded finance trend is making a big impact across various industries, with e-commerce, ride-sharing, and online marketplaces being prime leaders and beneficiaries. According to a report by Business Insider, embedded finance is projected to reach a market cap of $7.2 trillion by 2030, while 79% of UK banking executives reported in May 2023 that they hear the term at least once a week. These statistics underline the transformative impact of embedded finance, emphasizing the necessity for forward-thinking business leaders to explore how it can meet their business needs, enhance B2B interactions, and elevate customer satisfaction.

Seizing the Opportunities

Embedded finance is setting unparalleled benchmarks in user experience and operational efficiency. For businesses aspiring to stay ahead of the latest industry trends and curves, tapping into the possibilities of embedded finance is crucial. It not only provides them with comprehensive alternatives to their existing financial solutions, adapts them to the ever-changing demands of their clients, but also lets them realize streamlined internal financial solutions. From a business point of view, this isn’t the first time innovations in financial technology have enhanced the efficiency of businesses. Looking inward, instead of having to complete year-long integrations with multiple payment service providers, payment orchestration software provides a consolidated single integration to hundreds of PSPs allowing businesses to optimize their payment needs. Going forward, it seems inevitable that more and more financial technology companies will engage on a deeper level with embedded financial solutions.

Embracing the Future

Embedded finance is clearly in the here and now, and it’s important for businesses to leverage this latest technology to stay ahead. Integrating financial services into diverse industries that have historically not included financial-related products is a huge opportunity for industry growth and diversification. As consumers increasingly come to expect embedded financial solutions in their engagement with businesses, so will businesses come to expect embedded financial solutions in their relationships with other businesses. What’s certain is that the way financial services are delivered and experiences are changing and businesses that are not adapting to the latest trends risk being left behind.