As a business owner, you most certainly strive to expand your brand’s reach, drive sales, and boost profitability. Using a single payment processor can limit your audience, and in turn, slow down your growth. Establishing a reliable way for your customers to pay for the products and services received should be your top priority.

However, not all payment technologies are created equal. Integrating the best, most diverse cashier systems is instrumental for your growth.

The limitations of traditional payment systems, which use just a single payment processor, can be bad for business. Here’s what you need to know to optimize your payment options and increase your conversation rate

Relying On A Single PSP Narrows Your Audience

Payment processor limitations include a dependency on a single bank. This is an inability to reach certain segments of your target audience, and forced adherence to particular payment rules. This places your business at the mercy of the bank’s payment service and infrastructure.

This can limit your control over your business’ payment experience. At the same time, force you to pay higher transaction fees, and experience delays in transaction processing.

Although, it’s not the only disadvantage having a single, traditional solution invites.

One payment processor means limiting your company to the business and sales of those customers who use a particular payment method. For example, if you only accept PayPal or standard credit card charges, you lose out on audiences who prefer to pay via Revolut payment applications.

A More Sustainable Payment Infrastructure

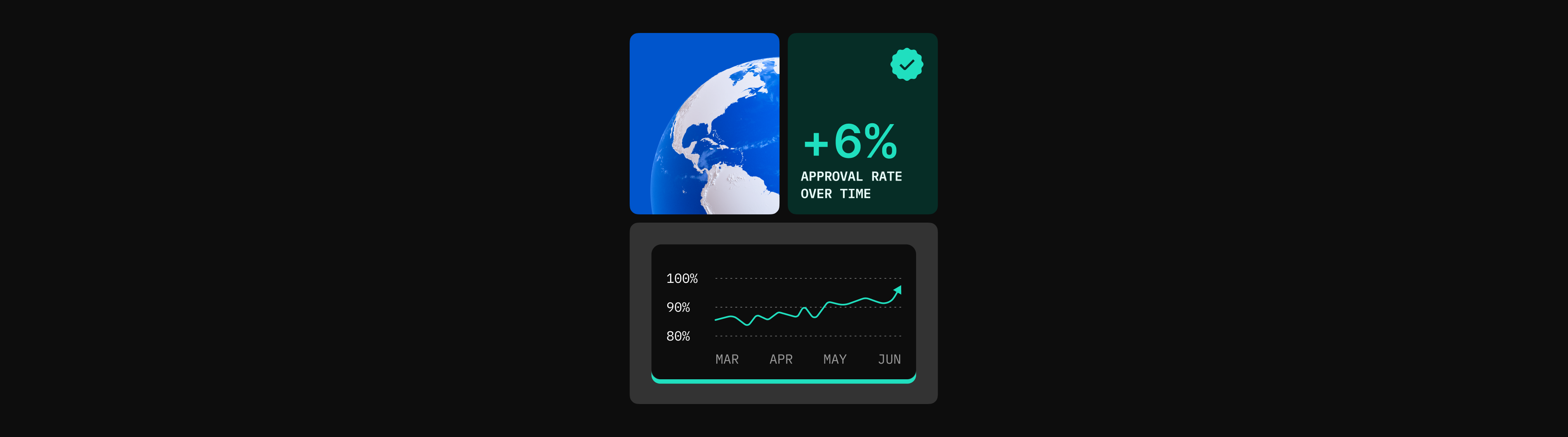

There are many advantages of utilizing a payment cashier that allows you to process transactions from multiple and diverse payment solutions from a single source.

The main benefit is, of course, your ability to control which audiences you reach. Leveraging a customizable and highly flexible cashier opens your doors to new and exciting demographics. In other words, this will also allow you to optimize your own rules and routes for receiving payments.

In addition, by integrating multiple payment solutions, you become empowered to ensure your customers receive the best possible service and support.

The flexibility of processing more payment options allows businesses to better meet customers’ needs. This, in turn, motivates more conversions and allows your business to increase its profits and scale.

Choose A Software That Generates Solutions

In conclusion, having multiple payment options makes your business more credible and user-friendly while opening your offering to more consumers, in more target markets.

In the world of consumer-centric service within which we live in, adopting the multiple payment option path is great for business. Not only that, it might be your business’ ticket to survival – and the boost it needs to grow and scale.

Therefore, partnering up with a payment software solution that grants consumers access to a selection of PSPs and alternative payment solutions to choose from will benefit your growth. Furthermore, this enables your business to ensure that payments are faster, in more currencies, and with proper reconciliation.

Whether your business focuses on Fintech, Online Gaming, Travel, or E-commerce, Praxis Cashier is the technology provider poised to create precisely the financial solutions you need. Praxis acts as a connector and introducer between payment service providers (PSPs) and business owners. Leveraging native software and unique contracts to handle all your businesses’ payments through many payment options, enhance your credibility.

Want to enhance your payments infrastructure? Contact Praxis today!