Partnering with a universal technology provider can help you roll with the fintech industry’s punches.

As more consumers demand cashless and contactless payment solutions, fintech has become a must-have for successful organizations. In our modern, customer-centric society, fintech is the indispensable tool that enables companies & banks to acquire a competitive edge. Payments technology adopters benefit from the added business drawn in by the promise of faster, more seamless, secure, and transparent transactions.

Although fintech is innovative, it is far from in its infancy.

Contrary to popular belief, the fintech industry has been around for decades. Born in 1886 with the initial introduction of transatlantic communication technology, fintech has come a long way. From analog transmission methods to the new, digital payment solutions and cryptocurrencies of today, fintech is here to stay.

But where is the industry headed?

First, what are the most important fintech trends today?

Despite 2020’s outbreak of a global pandemic of epic proportions – COVID-19 – 2020 brought with it significant growth to the fintech industry. While $128 billion was invested into fintech worldwide in 2018, that number is expected to surge to $310 billion by 2022! That’s a 25% annual growth rate!

Three significant trends are driving fintech’s future sky high.

First, the building or adoption of blockchain technology enables businesses and financial institutions to compound the benefits experienced from fintech. The distributed ledger technology enables faster, more direct, transparent, and secure payment clearance and settlement. Moreover, integrating cryptocurrency as a payment option invites more market segments to the transaction table, a win-win for all.

Second, in an era characterized by Covid-19 safe-distancing practices, going contactless and cashless while maintaining a personal consumer experience is paramount. Artificial intelligence (AI) is the tech that preserves and even amplifies a human feel within the digital-only banking world, where chatbot use abounds. Other benefits of AI on fintech include a better understanding of consumer demands, reduced risk of human error, the induction of previously unbanked persons, and an end to cash and credit cards.

Lastly, all-in-one tech providers are integrating the latest banking technologies, such as open APIs and cloud storage, to create added value and drive engagement. The more services included within a single digital ecosystem, the more these providers are able to scale, profit, and reduce customer churn. This is even more important than usual, in light of the Covid-19 inflicted economic recession.

How have these trends shaped the fintech industry thus far?

Broader, exciting prospects

The abovementioned trends all share something in common: they are opening the financial industry’s doors to everyone. When banks and financial technology providers collaborate, they are better able to learn and leverage evolving changes in consumer behavior and technology consumption. This, so as to provide financial institutions’ customers with the services they need, and the added value they crave, instilling in them trust and encouraging engagement.

The increase in functions and features made available to consumers, coupled with enhanced ease-of-use, makes it easier for more people to make and receive payments – at reduced costs. As such, more users are motivated to dip their toes into the economy, driving a better, more financially fruitful future for all.

A holistic, informed approach

As the fintech industry continues to transform the way in which financial institutions provide their services, it has become clear that a holistic approach enabled by financial technology providers is king. Fintech is to thank for this evolution in service models as well.

To provide consumers with all the benefits highlighted above, it is critical that all data be stored, studied, and utilized by all of a bank’s employees. Doing so not only ensures that everyone is able to keep up with the pace of business, but it also enables a more complete view of all that transpires within the financial institution itself. As a result, better insight into cash inflows and outflows are enabled, allowing the institutions to optimize their risk management and profitability endeavors.

How can you secure your financial future with technology providers to deliver?

The fintech industry is headed in the direction of a consistently improved user experience for all: businesses, consumers, and financial institutions. To achieve this goal, revitalizing your business or financial institution’s future with new and newly energized technologies that personalize banking and payment experiences is key.

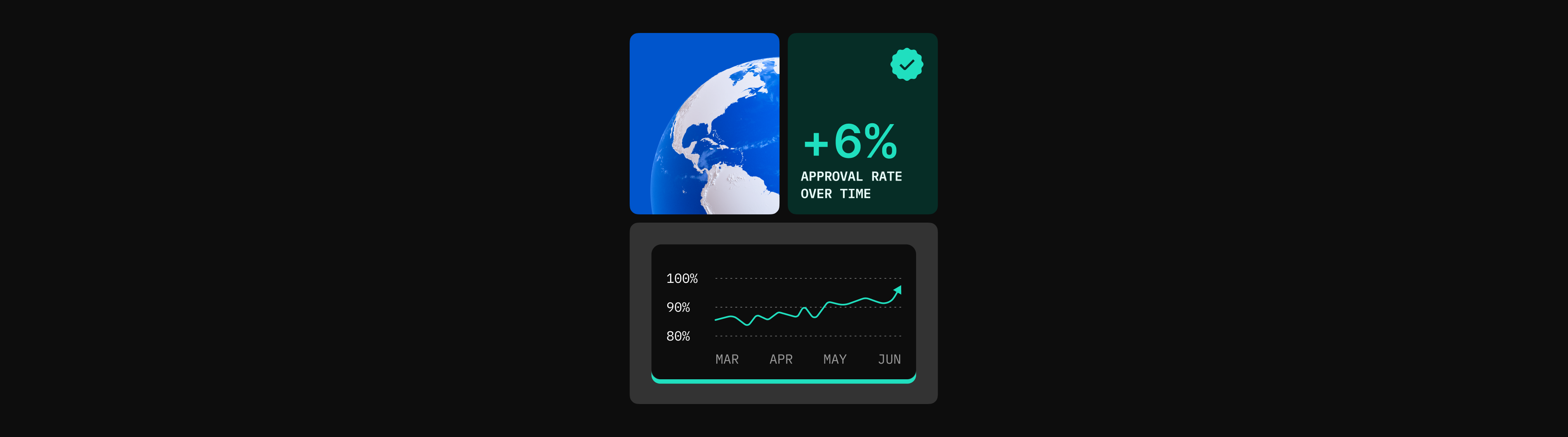

The future of the financial industry lies in the integration of fintech from financial technology providers that go above and beyond connecting or bridging your business with the right payment solutions. It is precisely a holistic technology provider that you need to truly succeed in an era of economic struggle, technological disruption, and consumer-centrism, and elevate your place of business. From reporting and analyzing, to smart routing, customization, payments APIs, and support, holistic technology providers are creating the ideal ecosystem for your secure financial future.

The future of fintech is now

The fintech industry is trending towards a more data-driven, service-oriented offering, and future-forward businesses and financial institutions can anticipate its ripple effects. With the latest fintech trends already shaping the current financial landscape, the need for collaboration with a holistic technology provider has never been more clear. Doing so will not only help you weather the Covid-19 pandemic, but it will also set you up for a promising and prosperous future.

Praxis is more than just your standard cashier provider. Praxis is precisely the all-in-one financial technology provider that is positioned to not only help your business stay afloat, but also nurture your growth and success, in all your online financial endeavors. So, what are you waiting for – cash in by checking out Praxis’ website today!