The world is undergoing a rapid and dynamic digital banking transformation. Like all other industries, finance has evolved to keep up with technological advancements. With the latest FinTech trends prioritizing faster, better, safer, and smarter processes that prioritize the consumer experience, the finance industry is changing – for the better.

One such result is the digital banking revolution. The field of banking as we knew it is no more. Online, mobile and Open Banking systems are taking the industry by storm, adding value to banks and consumers alike.

The more services digital banks can provide while increasing their return on equities and decreasing cost-income ratios, the better.

Here are three of the biggest trends pertaining to technology in the banking industry that are helping banks achieve this goal and survive the digital revolution:

Artificial Intelligence and Digital Banking

77% of banking executives believe that, of all digital banking technologies, artificial intelligence (AI) will be the most effective in 2021. This is especially true, as consumers seek highly personal and accessible experiences while adhering to Covid-19 safe-distancing practices. AI injects a human feel and smarter services and support into the digital-only banking world, traditionally staffed by chatbots.

Blockchain Technology and Crypto

Blockchain and cryptocurrency are poised to help banks achieve the high-security and seamlessness demands imposed by the digital transformation. By entering strategic partnerships or building their own blockchain solutions, banks across the globe are expediting money transfers. In addition, a distributed ledger technology like blockchain promotes more direct and comprehensive clearance and settlement of payments.

While traditional banks can take days to process transfer requests, with blockchain, the process is 388 times faster. This, while tapping into consumers’ credit history and tracking the process publicly to promote greater transparency and shareability.

Digital Ecosystems and All-in-one Tech Providers

A stark contrast to traditional banks, digital banking is trending towards becoming an ecosystem in and of itself. Therefore, this trend has become even more important in recent months, in light of the ongoing coronavirus pandemic and its subsequent economic recession. The more services digital ecosystems can provide, the better the finance industry will fare during these trying times.

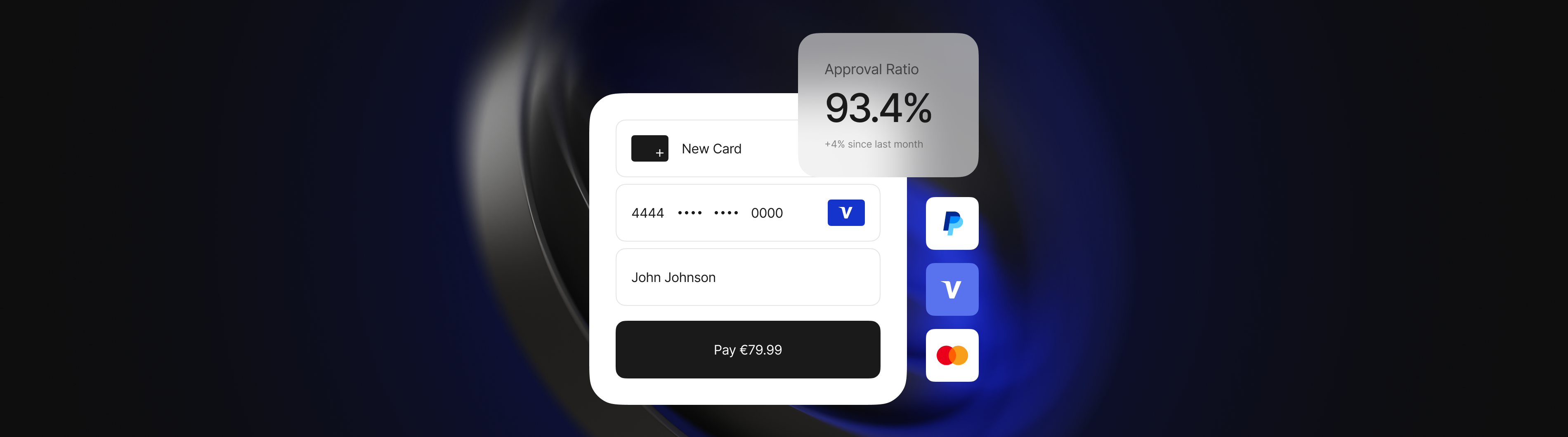

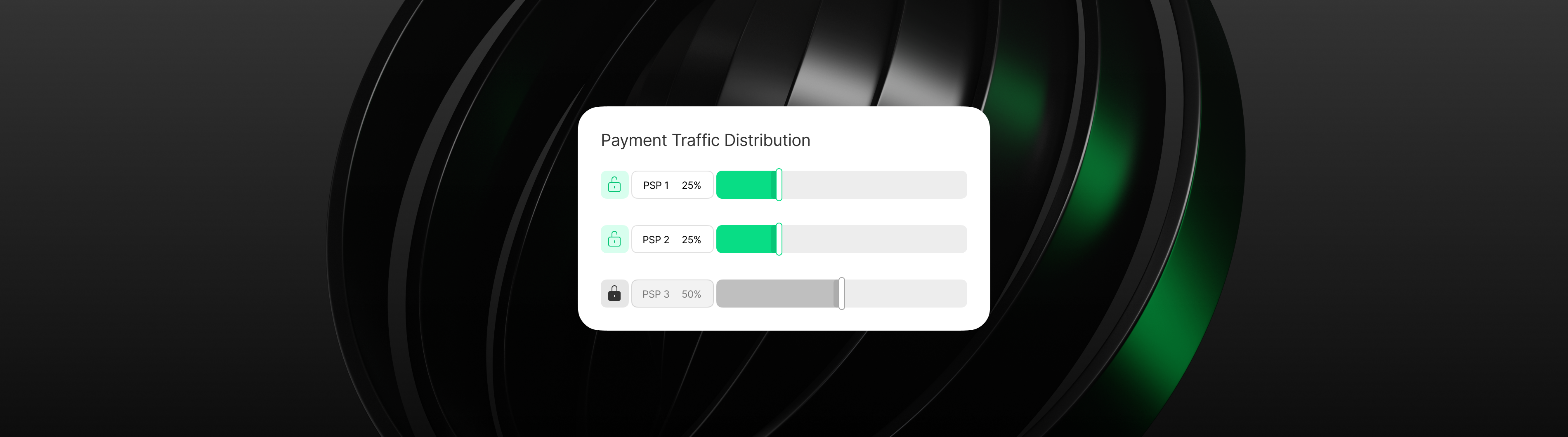

Based on intuitive, self-learning software programs, like machine learning and AI, digital ecosystems are creating a new customer journey model: the all-in-one. In addition, tech providers that integrate innovative modern banking technologies, such as open APIs and cloud will create value that attracts and engages more audiences around the world.

Primarily, these all-in-one tech providers benefit from expanded primary relationships, new revenue streams, and reduced customer churn.

Bottom line

The financial world as we knew is gone. In its stead, more innovative, digital processes are creating a more informed and expedient holistic financial ecosystem. Those who partner with trend-savvy tech providers are poised to benefit from lower costs and higher returns.

In other words, in the coming years, we expect to see these and new technology trends continue to transform the finance industry, shaping a future that is highly smart, seamless, and, and secure.

As an all-in-one payment solution, we at Praxis Cashier are excited by these trends. It is our mission and vision to continue to leverage impactful trends like these, and allow your payment processing to truly flow.