Did you know that a huge 60% of trading is actually psychological, with the other 40% made up by Strategy and Money Management combined?

That’s why it’s crucial to understand the psychology behind your client’s trading journey and optimize your client’s lifecycle.

Regardless of where an individual’s trading experience stands, your brokerage benefits when you have the knowledge of how to fully benefit from every trade – based on the emotions of the trader alone.

We’re going to explore how anger, fear, greed and ego all contribute to the four stages of competence when trading, and how to make sure your platform payments are prepared to cater to every emotion.

Unconscious Incompetence

Welcome to the very beginning of a trader’s journey. Here, an individual will have heard about trading from their friends, family or colleagues and it’ll pique their interest… At this point, a trader may have very little knowledge of trading, but they all want one thing: to make money.

Although the amount a newcomer is willing to trade may be lower than that of an experienced trader, harnessing the sheer number of new traders is essential. And, you can benefit from the large quantity of smaller trades! Having a seamlessly integrated cashier makes it easier for newbies to make quick and small deposits, and having a shorter deposit process reduces the likelihood that they abandon the transaction.

An array of payment methods on offer also helps the newbie to see that you’re a trustworthy brokerage, as having their payment method of choice on display and available to use acts as a reassurance mechanism. With an already trusted payment solution, a client will associate your application with said trust.

Conscious Incompetence

The next stage in a traders journey comes along when they are aware of how little they may know about trading and having a better understanding of the risks associated with trading overall. Traders will go and research the market as much as possible, to be more prepared for future trades.

As a broker, offering educational material, such as courses as well as financial charting and market analysis can add to the skillset of these traders. This can ensure a longer trader lifecycle, and increases trust in your brokerage. You’re effectively placing yourself as a broker that cares enough to ensure their trading success is paramount.

With all the effort put into learning the ins and outs of the market, these traders will be more likely to go the extra mile to start making a profit with their new found knowledge. Excitement, and the prospect of making money motivates these individuals to continue: Eager to learn, and eager to deposit repeatedly.

Additionally, if you’re able to provide risk management tools whereby your clients can control their losses more effectively, they’re more likely to deposit when they get closer to margin call.

A Moment of Awakening

This is the moment where traders understand that being successful/unsuccessful is having the right mindset. They will stop blaming the market and begin to acknowledge that they can’t always predict what the market will do. A system is created, and a long term plan is set in stone to benefit from the series of gains and losses along the way, regardless of the emotions they are feeling along the way.

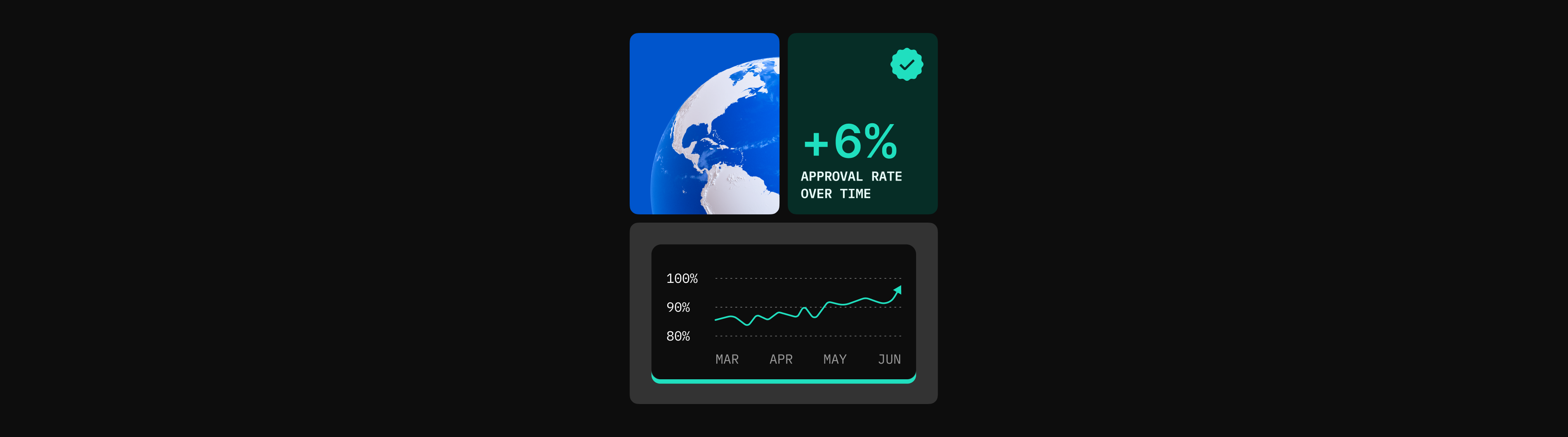

From this point you’ll have clients that are ready to deposit in a more structured and calculated manner in order to further their strategy. Deposits will tend to be larger which is where it’s important that you have a cashier with safety icons to indicate that their funds are handled safely. Additionally, you’ll benefit from having a payment orchestration platform where managing bulk withdrawals is simplified – enabling you to process faster and increase the ongoing trust you’ve already established with your clients. Shameless plug alert – Praxis allows you to do all that.

Conscious Competence

With all their hard work and new found knowledge gained, traders now try to keep to a more systematic approach rather than an emotional one. This allows traders to mitigate their emotional response to losing trades as they’re more confident in their trading & risk management system. Thus being more likely to make a profit over time, rather than making a “quick buck”. Money management becomes an important part of their everyday trading.

With confident traders, merchants are gaining loyal and long term clients. These clients will have made multiple deposits, and will continue to do so within their long term trading system. Giving your clients the option of recurring payments, or remembering their payment details is vital for smooth payments while trading. Making a deposit should be as easy as clicking a button, and this is what your traders expect. It’s also imperative to have this fast deposit mechanism in place should you cater to high-frequency traders or algorithmic traders; they need to ensure they can deposit quickly should they reach a margin call to keep their system intact.

Unconscious Competence

Ah, the top tier position for an experienced trader. This is the stage where traders follow their system seamlessly, and it becomes second nature to not have emotions based on their losses and gains.

As these individuals trade in an almost automatic way, they expect their payments to be automatic as well. The ease of a deposit and withdrawal process is the deciding factor of whether these traders will stay with your company, or find a competitor who has the payment solutions they want.

Offering the option to use Expert Advisors to your platform is a great way of encouraging an automatic trading experience for these traders. Having quick and easy payment options is crucial here. Traders will want to deposit on-the-go, from their phones on the train to work, on their lunch breaks or in between meetings without a glitch. Recurring payments and mobile payments are a fantastic way to achieve this flexibility for your clients.

The Final Statement

As traders embark on their Forex Trading journey, a broker can profit from every one of the stages reached by their clients. Having multiple payment options and fast, reliable deposits is crucial for brokers to optimize revenue. The truth is, making a payment shouldn’t be difficult, and if they can’t do this with ease with you, they’ll do it somewhere else. Reach out to us to discuss how we can Power Your Payments within the Forex Industry, to retain your traders and increase your client lifecycle!