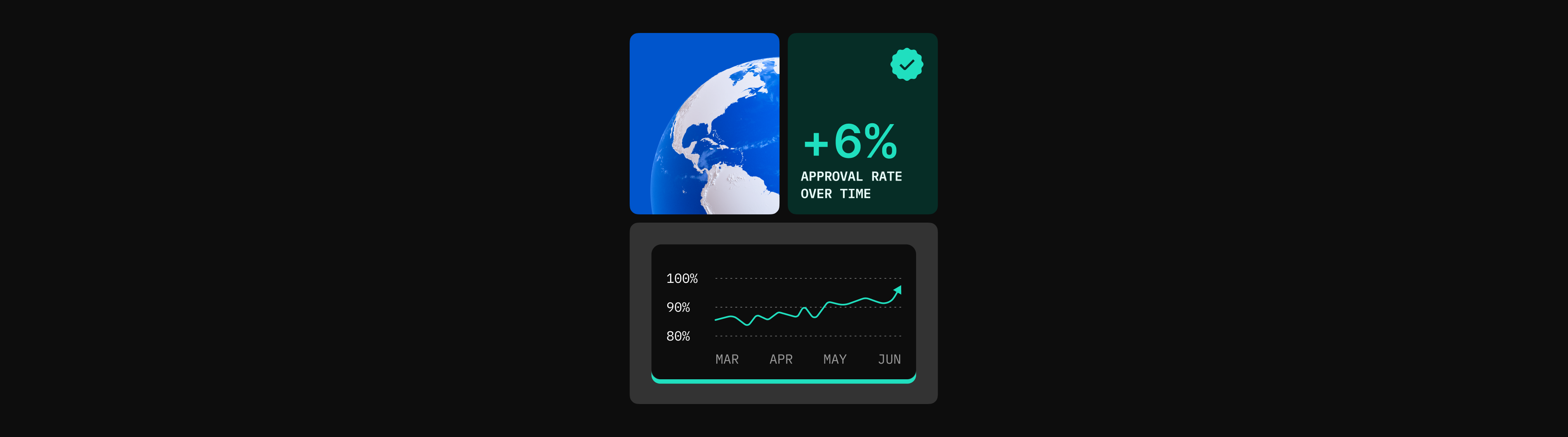

Collecting, analyzing, and leveraging transaction data across regions supports businesses to make strategic decisions that optimize their operations and meet their users’ payment preferences at the same time. As experts in this arena, Praxis Tech provides the tools and insights to power this process.

We all agree that with knowledge comes better decisions and results, and the same can be said when talking about payments. In the digital payments landscape, having the right information available to you is invaluable for enhancing and optimizing your transactions, particularly for online businesses that cater to diverse and global audiences. Understanding how to gather, evaluate, and action data-driven decisions to support your transactional journey is essential in working towards consistent growth and customer satisfaction. This article will explore the different analytical tools that come out to play when discussing how best to optimize payment infrastructures for online businesses and will spotlight Praxis’ own feature suite that supports these operations.

Understanding Payment Analytics

The term ‘payment analytics’ merely refers to the process of collecting and interpreting data related to processing payments and transactions. Armed with the right tools, online businesses can seamlessly monitor their transaction success rates, recognize the most popular payment methods of their user base, identify areas where there is friction, and detect emerging trends. Fundamentally, ‘payment analytics’ supports merchants to view the holistic picture of their entire transactional environment, offering their executives actionable insights and potential pathways for improvement.

Payment analytics can be compartmentalized into various different lens’ that support businesses in seeing why transactions may be failing, highlight to them what the most popular payment methods in different areas are, support them in keeping track of emerging payment trends, and provide them with the tools for forecasting peak demand periods and locations, all of which boost future planning and financial outcomes.

Breaking this down one by one:

- Reducing Declined Transactions

One of the core benefits of harnessing payment analytics is its ability to highlight transaction declines or failures. By tracking these failures, merchants can better understand if there's a recurring issue with certain payment gateways or methods. This data supports them in making timely changes, ensuring that potential customers don’t abandon their deposits or checkouts due to transactional hiccups. - Accepting their customer’s chosen payment method

User preferences for payment methods vary widely from one region to another. Some areas may lean heavily towards credit cards, while others might prefer digital wallets or even local payment options. By analyzing transaction data, merchants can identify these preferences and offer the most sought-after methods, enhancing the customer's checkout experience. - Adapting to Emerging Trends

The use of Alternative Payment Methods (APMs) differs greatly across continents like Europe, Asia, and North America for example, with evolving trends consistently surfacing. By effectively analyzing their payment data, businesses can proactively adjust to these shifts, ensuring they meet the dynamic payment preferences of their worldwide customer base. - Efficient Financial Planning

Payment analytics can also support online businesses in forecasting and budgeting. By understanding their transaction trends, seasonal variations, and customer preferences, businesses are supported to plan their financial strategies more effectively.

In addition to Praxis’ CSV Report Generation tool - which simplifies data extraction and reduces loading times for efficient transaction report generation - Praxis Tech’s suite offers merchants advanced features that analyze more than just the surface metrics. The Cashier Events feature, for instance, provides insights into each customer’s checkout or deposit session, enabling merchants to fine-tune their payment processes for optimal conversion and approvals. Additionally, with Recovered Transaction Flagging, businesses can precisely see where transactions have been saved through Praxis’ Decline Recovery strategies, giving insights into enhanced revenue streams. Essentially, while broad payment analytics are vital, it’s Praxis’ advanced tools that provide an extra edge, further empowering merchants.

A Case in Point: Global Companies and Payment Pathway Optimization

Global companies, with their expansive reach, often encounter the complexities of catering to diverse markets with varied payment preferences. Here's an illustrative scenario:

Imagine an international online gaming platform with a significant footprint in both Europe and Asia. Their European players might primarily favor debit or credit cards, while their Asian counterparts could display a rising preference for mobile wallets or local banking solutions. Without strong payment analytics, the online gaming platform might overlook this shift, potentially losing valuable deposits.

Moreover, if a certain payment method continually results in declined transactions in a specific region, it's important for the gaming business to quickly detect and address this issue. By acting promptly, they not only facilitate seamless gameplay for their customers but also enhance player trust and allegiance. Not many customers would try depositing for a third, or even a fourth time.

In essence, for global companies, payment analytics is not just a tool - it's a strategic asset that ensures they remain adaptable, efficient, and customer-centric.

Key Takeaways

It’s clear that data should drive strategic decisions, and payment analytics stands out as one of the most important evaluating tools for online businesses that cater to global audiences. As experts in this field, Praxis Tech not only offers general analytical insights but also adds value with its specialized features, empowering businesses to enhance their transaction success rates across continents while meeting the evolving payment preferences of their user base. Contact us at hello@praxis.tech to find out how your business can benefit from our advanced analytics feature suite and payment orchestration platform.