When was the last time you paid by check? If ever, did you or didn’t you feel like a millionaire in that moment? Well, we have some bad news. The once-popular slip of paper will officially be added to the history books by 2030, with the Australian Government joining others in announcing its gradual discontinuation.

Are you an Australian who still pays by check? Check-mate.

Payments have over the last decade evolved at an incredible pace, and if the last 10 years are any indicator, by the end of this decade even more dramatic changes in how consumers and businesses send, receive, and manage money, will be equally innovative.

This article looks at some of the ways you and your business will be transacting in the near future and makes the point that the payments of 2030 will focus heavily on user experience.

Merchants succeeding in this space will have payment interfaces that are seamless, mobile, self-serve, and sometimes invisible.

Speed takes a front seat

Just like cash was the original Real-Time payment method of the past, open banking-powered Account-to-Account (A2A) transfers, and alternative instant payment methods will continue their upward trend, representing almost a third of all online payments by 2027. The era of waiting for funds to clear is ending, as is the cash era, with PwC predicting the cashless uptake by 2030 to increase by 200%.

Consumers have already widely embraced tap-and-go NFC and RFID-powered contactless payments for their physical payments, and have come to expect equally frictionless experiences online.

With advances in biometric authentication using technologies like fingerprint, face ID, and even Optic ID if you want to pay using your brand new Apple Vision Pro’s (just don't blink), digital payments will become even more secure and convenient.

Added incorporation of AI and machine learning-powered pattern recognition will also further protect consumers and businesses from fraud. We'll have more to say on this soon, subscribe to stay informed!

Meanwhile, automated and embedded payments will make transactions invisible.

Popular invisible payment methods like subscription and recurring transaction methods are also forecast to continue their upward trajectory by 2030, as are Internet of Things (IoT) payments, and the ease of automatic payments will trickle down from business-to-customer (B2C) relationships to business-to-business (B2B) transactions.

Called “programmable payments” by Mastercard, this will allow businesses to pre-program commercial transactions to initiate automatically based on pre-set rules.

Think pay-per-use meeting rooms or leasing of capital-intensive machines B2B payments, that have been pre-approved by the finance department. This is similar to pre-approving a payment for an Uber, but the business equivalent for supplier invoices and more.

“Programmable payments could evolve from niche use cases to become an industry norm by 2030.” - Mastercard Signals Outlook

Of course, the payment elephant in the room is that we all fundamentally pay with currencies, and there are some interesting developments on the horizon for these too.

The Atlantic Council has done the math and found that 114 central banks representing 95% of global GDP are currently exploring Central Bank Digital Currencies (CBDCs), which are in their infancy and are being thought out as a reaction to increasingly more popularized blockchain cryptocurrencies.

The European Central Bank’s work on the Digital Euro will be of increasing interest to many as we approach 2030, and for those who want to stay informed, the Atlantic Council has a live CBDC tracker.

Key Takeaways for Merchants

What’s certain is that the payments by the end of the decade will see enormous leaps in how we pay and get paid. At the core of all these solutions is the technology to make transferring value easier and more embedded in our personal and professional lives.

Payments will fade conveniently into the background and tedious forms, lengthy bank transfers, and confusing checkout flows will disappear in the next wave of payment innovation.

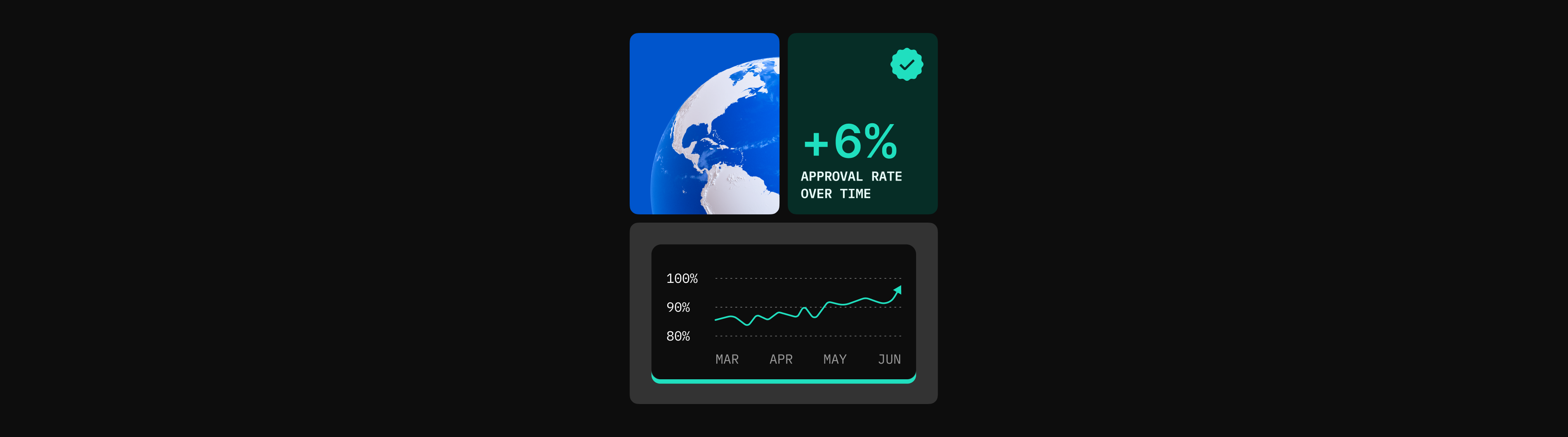

For businesses who want to ensure their payment operations are ahead of these trends, get in touch with Praxis Tech to learn how our payment technology platform supports online businesses to optimize their send and receive transactions through an enhanced checkout experience, providing increased approvals, security, and analytics.