Have you ever put something into your virtual cart, only to realize that the seller takes a payment method that requires you to fetch your wallet, whether for cash or your credit card info? Or worse, they don’t accept your payment methods in the first place.

Customers go through this disappointment all the time, especially international ones. Good news is, there’s a solution. Alternative payment methods (APMs) are a great way of paying for goods or services without using cash or major card schemes.

What are the different types of APMs?

While some of these options are becoming more mainstream, they are still considered Alternative Payment Methods. Overall, they are more niche and specialized forms of payment.

Digital Wallets

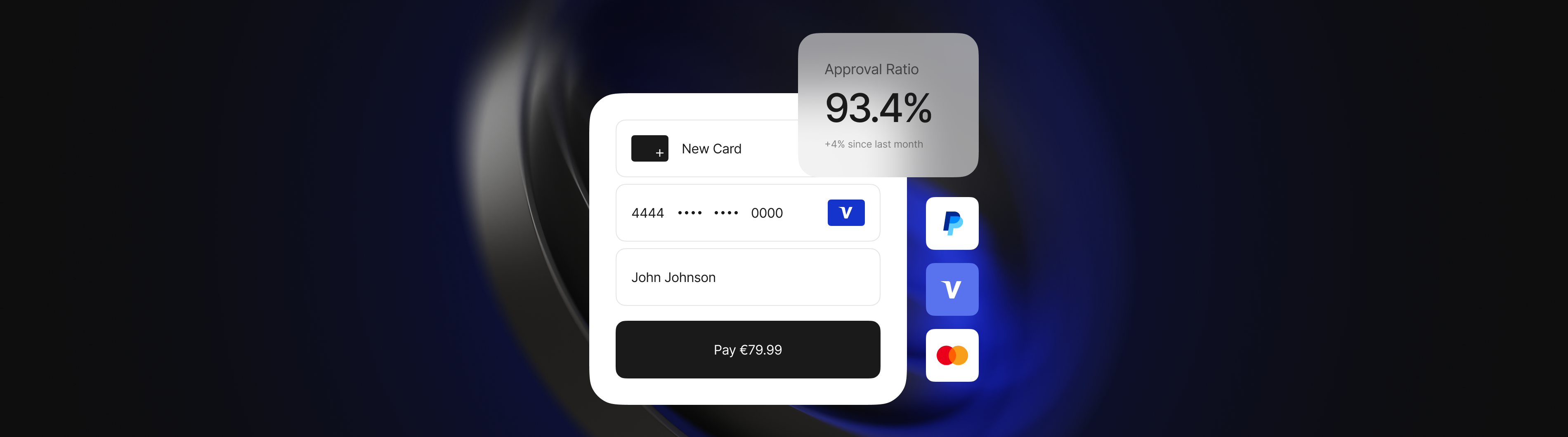

Also called e-wallets, digital wallets allow customers to store funds. Customers deposit money into their e-wallets via bank transfer, card, or cash. They can shop with these digital wallets online, offline, person-to-person, and even across borders. Popular digital wallets are PayPal and Alipay.

Mobile Payments

There are countless types of mobile payments. Variations of the digital wallet provide extra usability. With pass-through wallets, you can generate tokenized numbers for each transaction (think Apple Pay and Google Pay). Some even allow customers to pay via QR code or an SMS, all contactless and convenient.

Bank Transfers

Bank transfers are pretty self-explanatory. Some people prefer bank transfers over using cards or other payment services. They can pull money from their bank accounts to directly pay for goods or services online. Examples of this are iDEAL and Sofort.

Direct Debit

Customers love when they can make recurring payments without having to input their payment information every single time. After customers give their consent for an agreed service, direct debit payments can automatically pull funds from their bank account of choice. Examples include SEPA Direct Debit and ACH.

Buy Now, Pay Later

Abbreviated as BNPL, this method lets customers pay the whole amount later or pay in several installments. These are typically funded via a bank account, debit card, or credit card. Affirm and Klarna are examples that offer BNPL services.

Cryptocurrencies

Crypto is volatile. Even more stable digital currencies like Bitcoin are currently fluctuating and going through tough, bear markets.

That doesn’t mean that there isn’t a substantial group of potential customers who enjoy using crypto to pay, so it’s good to keep your options open. Some merchants even prefer it when customers pay in cryptocurrency.

Local Cards

Local cards are a great way to cater to local demands if you sell goods and services in that particular location. For example, in Belgium, shoppers use Bancontact far more than Visa and Mastercard. You can discover what resonates with your target audience with a little local market research.

Why should you use APMs?

Now that you know the various APM types, it’s naturally time to gauge the pros and cons of implementing APMs for your business. Here are some of the top benefits of using APMs.

Global Relevance

APMs act as a sort of global bridge, allowing more international clients to interact with your business. Potential customers who don’t have Visa or Mastercard aren’t left annoyed at the checkout page.

Now, you might wonder if opening your goods and services to international clients is financially beneficial to you. You’d have to implement a whole new payment system, so it needs to be worth the hassle. The short answer is, yes!

- Sub-Saharan Africa accounts for around 45.6% of the world’s total number of mobile money transactions.

- An Oxford Economics partnered study showed that 56% of consumers report that they permanently stop shopping at a site that doesn’t offer their payment method of choice.

- Experts predict that APMs, direct debits, and bank transfers will exceed cash and card by 2023.

- Europe sees 59% of online purchases made through APMs and 48% of in-store transactions funded via APMs.

Cracking open the door to international revenue can grant you so many new opportunities, and it can be as easy as using alternative payment methods!

Faster Checkout

It’s the era of convenience beats all. The faster and easier the checkout process, the lower the chances of shopping cart abandonment. APMs mean that shoppers don’t need to fill out credit card forms, and that added convenience can boost your conversion rate.

Even for financial and software companies that offer relatively pricier services, just having that alternative payment option can help clients feel more comfortable purchasing from you or putting down a deposit.

Security and Trustworthiness

The truth is, APMs haven’t been proven to be much safer than conventional credit card deposits. But the perception of being safer is there, and that matters a lot.

Through APMs, clients can use Fingerprint ID, Facial Recognition, and App Passwords – all of which make them believe they can avoid fraudulent activity better. An added sense of security means they are more likely to complete the checkout process.

Even if there are customers who might be wary of using a new payment solution they have not heard of, you can help them feel even willing to follow through with APM transactions. One way is to offer a Payment Solution that the customer already views as trustworthy.

Find the Best APMs with Praxis Tech

The way people pay for products and services is constantly evolving.

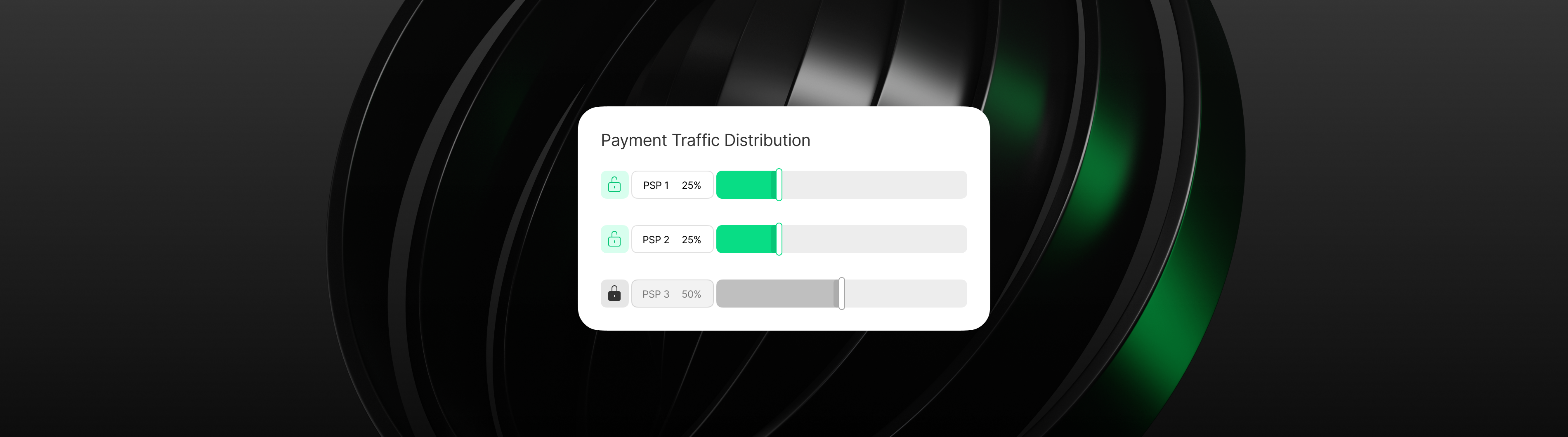

Praxis Tech is here to help you set up your APMs flawlessly. Our product is one integration, one dashboard. This way, you can easily connect with APMs targeting worldwide locations based on your needs and goals. Europe? We got your back. Africa? No problem.

Praxis offers 1000+ APM integrations! With a super cool Payment Method Order based on location and currency, we can offer you more freedom to direct clients to specific payment methods.

It can seem daunting to dive into a whole new group of payment methods, especially when there is an abundance of choices. No sweat. We have an entire team dedicated to empowering you and guiding you through all of this!