First things first - the subscription economy is not just changing the way we buy, it’s changing the way businesses sell, and marks a new era in consumer-business relationships. Powered by the latest advances in recurring payment practices, merchants across all industries are maintaining long-term relationships with their customers in ways that historically have only been promoted by household utility companies, insurance providers, and your favorite physical magazine subscriptions.

The model, which shifts from traditional pay-per-product methods to subscription-based businesses, has cut through all industries, including online games that offer legendary and premium accounts and increasingly trading and banking services, popularly seen in tiered subscription-based accounts offered by Revolut.

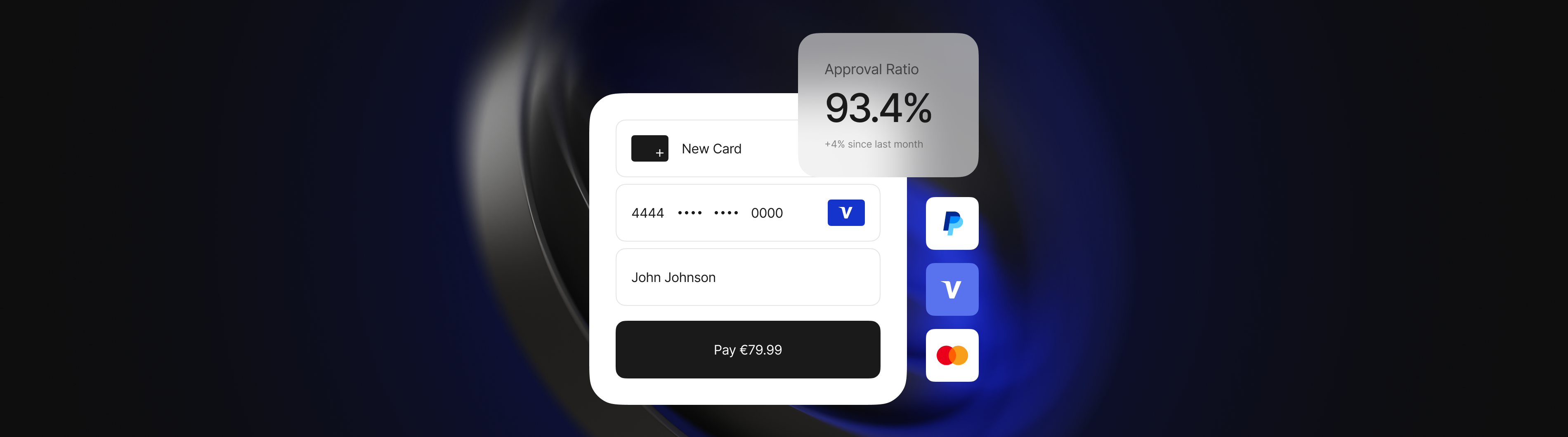

Merchants who meet their customers’ payment expectations can expect greater conversion rates.

Coming up:

- From games to banks, everyone’s trying monthly payments

- The need for speedy billing systems that speak your CRMs language

- The end of Direct Debits and the dawn of open banking powered Variable Recurring Payments (VRPs)

A New Business Standard: Monthly Recurring Revenue

From Adobe’s entire software suite to Monzo Free, Monzo Plus, and Monzo Premium subscription-based bank accounts, the subscription economy extends beyond only SaaS and financial services industries to include travel sectors, where airlines and hotels offer subscription-based discounts and even everyday services like car washes, food deliveries, gyms, and your kids online game all have tiered account options. The shift is clear: we are no longer subscribing just to streaming services.

For B2B companies, this shift has been transformative. The focus now is on achieving Monthly Recurring Revenue (MRR), a model that offers predictable and steady income, enhancing business stability and forecasts, and has led companies to look inward at both their customer engagement strategies and their payment operations.

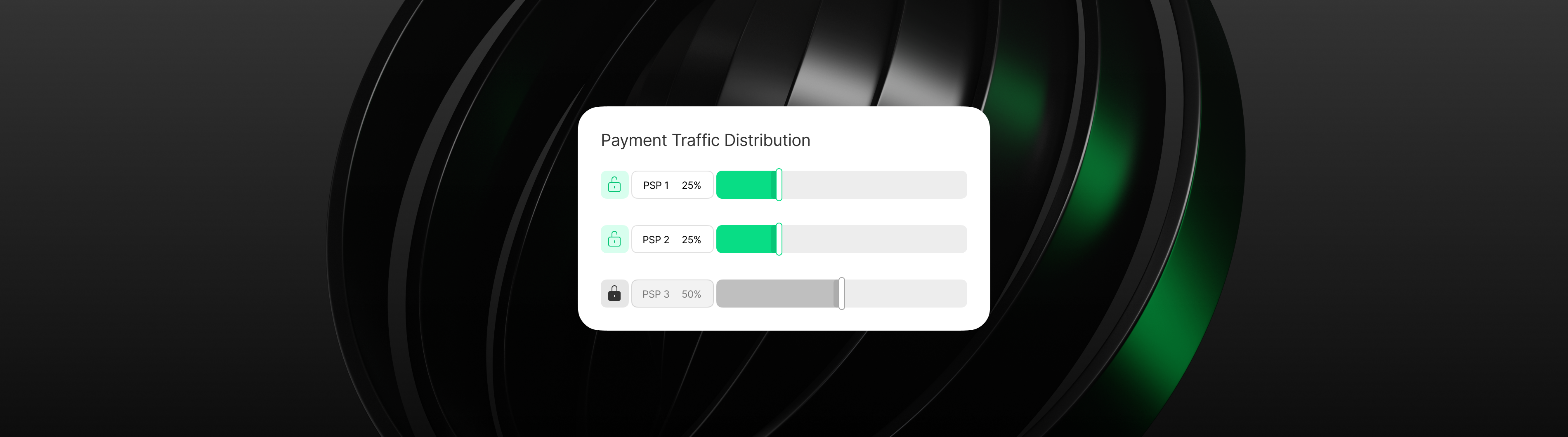

Remember, the implementation of recurring payments isn’t one-size-fits-all.

Merchants must decide on the frequency of billing and whether the amount will vary based on service consumption, such as GBs of data used in a month, and how many different premium tiers there’ll be in iGaming suites, offering consumers legendary game benefits, or your standard premium account.

Advanced Billing Systems and Customer Experience

The tech powering all these recurring payments is as diverse as the tiered models themselves. For merchants, having the necessary systems in place to successfully onboard new customers, confirm payments, notify customers, and integrate their information into a CRM system is fundamental to the successful operation of a subscription service.

For their customers, having a diverse set of options (including the popular low-risk free trial to paid subscription) is equally as important, as they transition from tryers to buyers.

*Merchants looking for these payment solutions should visit our Contact Us page. Praxis’ payment solutions come pre-integrated with your most used CRMs, saving you time, costs, and the effort.

What does the future look like?

Introducing Variable Recurring Payments (VRPs) powered by Open Banking APIs

The era of traditional Direct Debit, once a standard, is now fading into the past, making room for VRPs. These are delivered either through your preferred Third Party Providers (TPPs) or directly from some banks. It's crucial to recognize, though, that VRPs are mainly a UK innovation right now, and as of late 2023, only a select number of banks are required to support them. While other banks may choose to adopt VRPs, their availability isn't yet widespread.

Known as Dynamic Recurring Payments (DRPs) in the EU, VRPs excel in their ability to execute almost immediate Account-to-Account (A2A) transactions. This is a significant leap from the traditional Direct Debit process, which could take up to three days to clear. As for the EU, DRPs are still under development, and there's no definite timeline for their obligatory adoption and broad integration.

Initially designed to aid in more consistent saving practices, VRPs will enable merchants to deduct varying amounts directly from customer bank accounts at regular intervals under specific pre-set conditions, including the maximum amount that can be taken in one go, per day, week, month, or even year.

The quick transfer of funds, often within just 10 seconds, positions VRPs as ideal for sectors like trading, where timing is critical. Additionally, VRPs support one-click checkouts; as after a consumer approves a VRP, further transactions bypass the need for repeated Strong Customer Authentication. This not only speeds up the payment process but also upholds security.

Key Takeaways

More likely than not, your customers want recurring payment options.

Recurring payments have already made a monumental impact on entire industries and today and tomorrow lead to sometimes uncomfortable questions for consumers, such as ‘Do I really own this product, even though I’ve paid for it?’ and ‘Why should I pay $18 a month for a subscription to turn on heated seats in my BMW?!’ The shift from traditional purchase to subscription models, driven by global merchants across various sectors, signifies a major change in consumer-business interactions.

Businesses looking to incorporate the latest payment trends into their checkout, deposit, and withdrawal customer experiences would benefit greatly from a payment orchestration platform designed with their needs in mind. As a payment technology firm, Praxis Tech is dedicated to supporting merchants to integrate various alternative payment solutions. Get in touch to learn more about how we can support your business’ payment strategy and operations.