In today’s fast-paced digital world, credit and debit cards have become our go-to method for making purchases. Whether it’s a sales transaction, an authorization transaction, or a capture transaction, these different types of card transactions play a crucial role in the world of commerce.

Sales, Authorization, and Capture Transactions in Card Payments

Sales transactions are a type of credit or debit card transaction where the merchant charges the customer’s card immediately. Authorization transactions are when a merchant obtains approval to charge a customer’s card for a specific amount, but the actual charge may not be made immediately. Capture transactions are when a merchant completes a previously authorized transaction by charging the customer’s card and transferring the funds to the merchant’s account.

Managing Refund Costs: The Difference Between Sales, Authorization, and Capture Transactions

One of the risks that merchants face with sales transactions is the cost of reverting a transaction in the event of a refund or chargeback. With sales transactions, the merchant has already charged the customer’s card, so if a refund is requested, the merchant will need to issue a credit to the customer’s card. This can result in additional costs for the merchant, as they may be required to pay fees to their payment processor or acquiring bank for the refund.

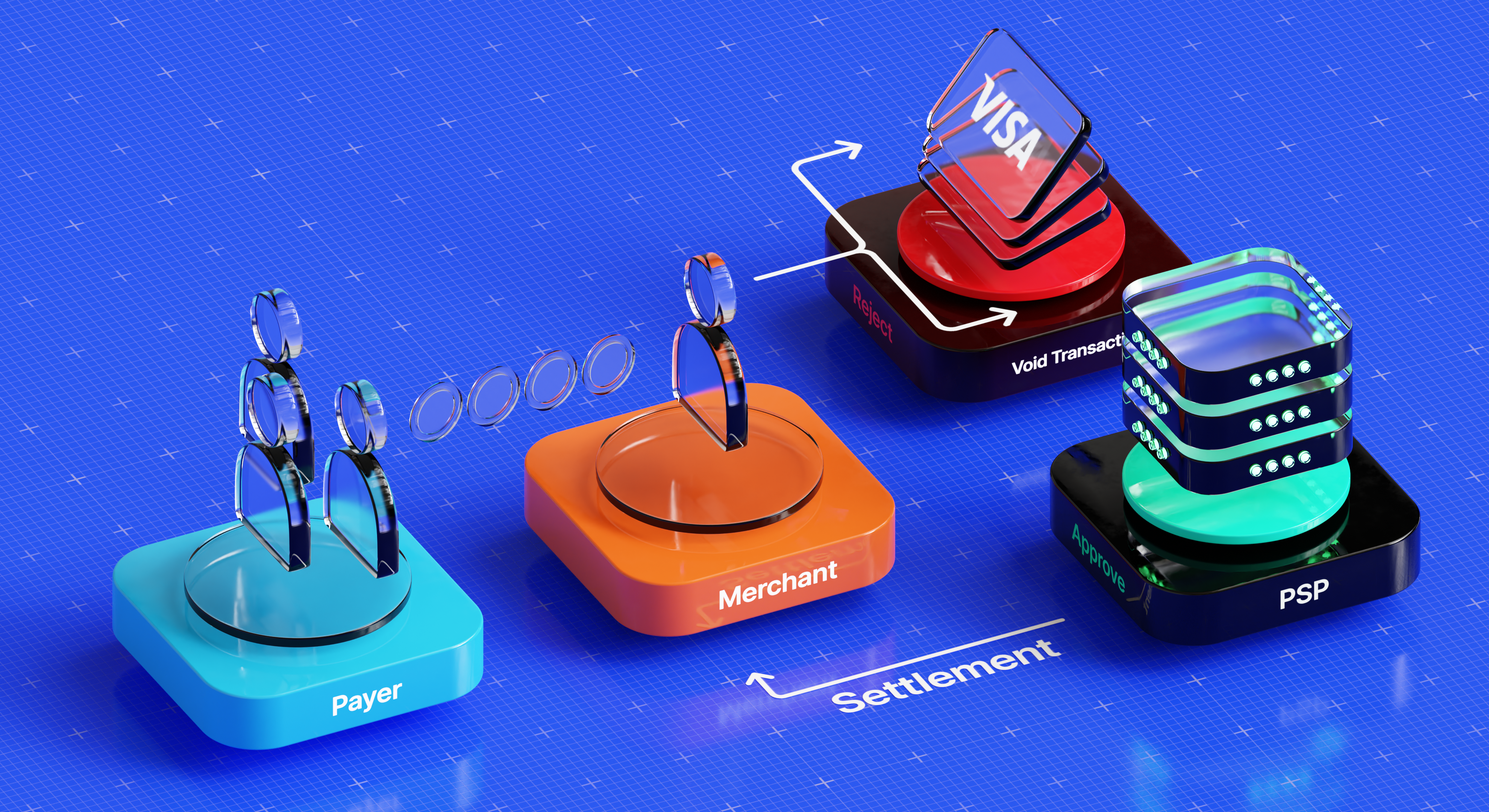

In comparison, with authorization transactions, the merchant has obtained approval to charge the customer’s card, but the actual charge may not be made immediately. This means that if a refund is requested, the merchant can simply void the authorization and the customer’s card will not be charged. This can help minimize the costs associated with refunds, as there will be no charge to reverse and no fees to pay to the payment processor or acquiring bank.

Capture transactions are similar to sales transactions, but with capture transactions, the merchant has already obtained authorization to charge the customer’s card and has subsequently charged the card and transferred the funds to their account. In the event of a refund or chargeback, the merchant will need to issue a credit to the customer’s card, which can result in additional costs similar to sales transactions.

In addition to the cost of reverting a transaction, merchants also face other financial risks with sales transactions, such as payment fraud, chargebacks, returns and refunds, payment processing fees, and foreign currency exchange risk. To mitigate these risks, merchants should implement effective fraud prevention measures, maintain clear return and refund policies, monitor their chargeback rates, and regularly review their payment processing fees. They should also consider using authorization transactions where appropriate to help minimize the costs associated with refunds and chargebacks.

In conclusion, while sales transactions offer the advantage of immediate payment, merchants should be aware of the potential costs associated with reverting a transaction in the event of a refund or chargeback. By using authorization transactions where appropriate and implementing effective risk management strategies, merchants can help minimize the costs and risks associated with sales transactions.