Exciting developments from the EU earlier this month promise to resolve a major pain point for consumers and businesses alike - slow payment transactions. Members of the European Parliament have passed new rules that will require banks and payment service providers (PSPs) to enable funds to be sent and received within 10 seconds, 24 hours a day, 7 days a week.

This new mandate will upgrade the existing Single Euro Payments Area (SEPA) system that businesses rely on today, where 3-day money movement is far too common. And while Instant Payment methods are already widely available across the EU, this will make the technology available to all - at no extra cost.

What’s Changing?

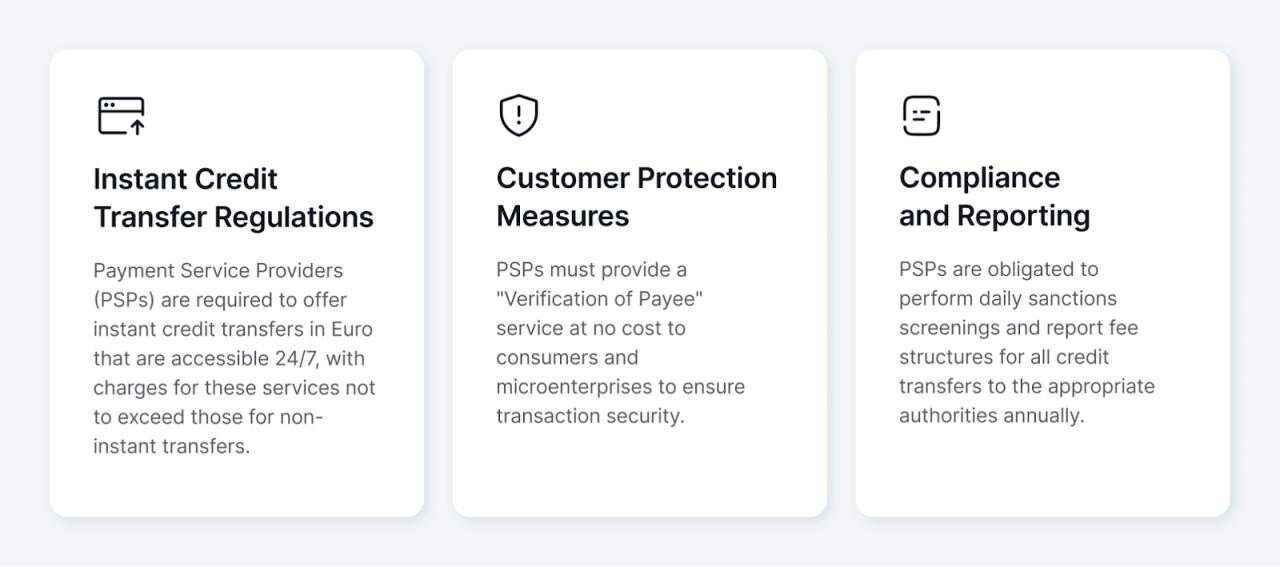

The new EU payment legislation stands on three key pillars:

Euro area PSPs and banks have a nine-month window to integrate technology for receiving instant Euro credit transfers and eighteen months for sending capabilities. Non-Euro EU member states Bulgaria, Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden have a slightly extended timeline for compliance, with rules specific to Euro currency accounts.

So, what’s driving this change?

Essentially, the EU has lagged behind other regions in enabling Instant Payments for some time now, and policymakers want European countries to catch up. A recent report showed only 11% of payments within the Eurozone used real-time transactions in Q1 2022, despite the technological infrastructure being in place.

This new regulation will bring Real-Time Payment infrastructures to the global mainstream, which is good news for everyone, everywhere.

The EU, despite being the largest trading bloc in the world, is comparatively a small fish when it comes to the adoption of Instant Payments in global economies. For example, India saw an incredible 89.5 billion real-time payment transactions take place in 2022, growing over 75% in a single year. And Brazil - after introducing its PIX instant payment scheme - recorded a 228.9% year-on-year growth rate, with 29.2 billion real-time payment transactions recorded in 2022. China, Thailand, and South Korea are also ahead of the curve.

Almost a third of all digital payments worldwide are forecast to use real-time methods by 2027. That’s over 500 billion transactions worth trillions of dollars.

Despite its size, the EU's adoption of instant payment methods is gradual. According to ACI Worldwide’s report, only four European countries – the Netherlands, Sweden, Denmark, and Finland – are expected to be in the top 10 for real-time payments adoption by 2027.

In contrast, larger GDP economies like Germany, France, and Italy are forecasted to rank significantly lower in consumer adoption, globally ranking 34th, 35th, and 42nd in respectively.

India, Brazil, China - and now Europe - are evidence of an accelerating trend.

Governments and regulators are also competing against the private industry to lead in instant payments. Brazil's popular PIX was developed by the country's Central Bank, while India's UPI payment method originated from its National Payments Corporation, an initiative of the Reserve Bank of India.

The US Federal Reserve last summer also launched its own FedNow payment solution, and just this week, Qatar's Central Bank announced a real-time payment service called FAWRAN. As innovation accelerates globally, both public and private sector solutions are emerging to meet surging demand for real-time capabilities.

Key takeaways for businesses

For businesses, it’s an exciting era. While the technologies to send and receive money instantly on a global scale are not new, their accessibility and benefits will have a greater reach, supporting day-to-day business operations for more and more merchants. On the consumer front, the demand for real-time, round-the-clock payments will only grow.

This shift brings immense opportunities to delight customers and improve operations.

For businesses eager to integrate real-time payment methods, whether through Open Banking solutions like Account-to-Account (A2A) transfers or alternative instant payment methods, Praxis Tech is connected with over 540 global PSPs and supports over a thousand alternative payment methods. Get in touch.