Having a payments API improves your clients’ journey, making it a must-have for any business looking to grow

Nothing makes for a better business than having happy customers. Integrating a payment gateway to simplify and streamline online payments will help you satisfy your customers’ needs for fast, seamless transactions.

A web payments API is exactly what you need to manage your digital payments. Doing so takes buyers swiftly through the checkout process, so they’re less likely to experience errors and abandon their cart.

As such, a gateway API is your gateway to an improved client journey and endless business opportunities and growth.

What Are Payment APIs, Really?

Application Programming Interfaces (APIs) are software intermediaries that enable two applications to seamlessly communicate with one another and share data, in real-time. In particular, payment APIs allow buyers to share their payment information with e-commerce sellers, so that transactions can be processed faster, securely, and at a lower cost.

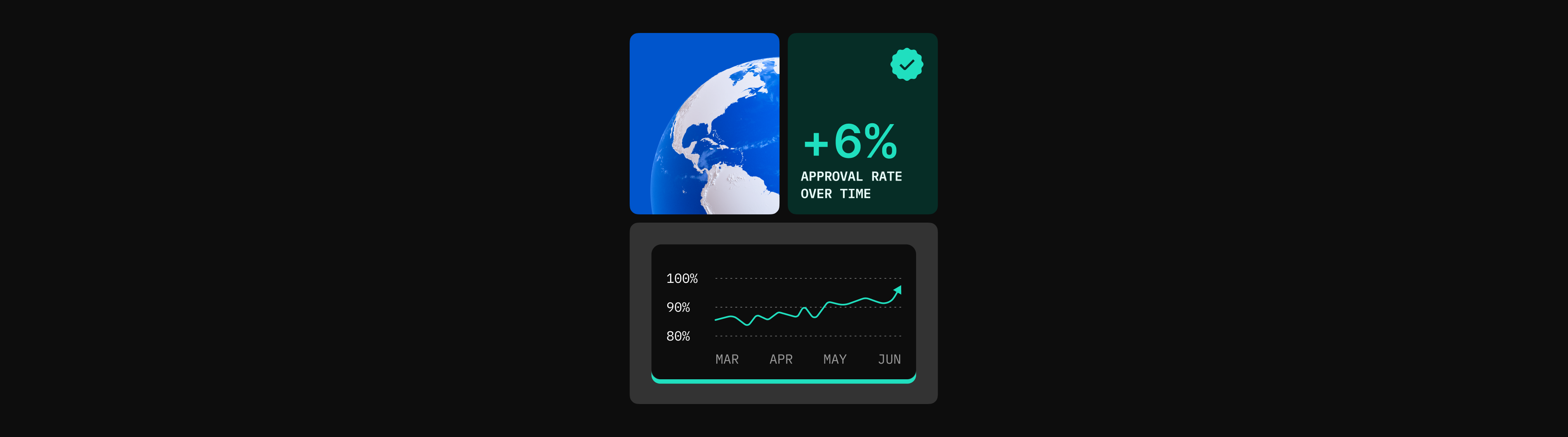

This way, online brands can scale to new markets, instantly settle bills, avoid data entry errors and payment fraud – and more – while complying with all relevant regulations.

Payments APIs can be used to process credit cards, track orders, and manage customer lists while integrating multiple payment sources. This makes them applicable to any type of online business, particularly those seeking to expand their reach, without compromising on customer service.

Payments APIs – Their Critical Role

Having a smooth, reliable API that meets the needs of both your company and your clients is critical to your success and growth online. To truly optimize your payment process, the API you choose should be customizable according to your front-end and back-end needs.

Equipped with a top-performing payments API, your business can offer customers a wide range of payment options. Aligned with your branding, and from more than one place. Doing so will increase your business’ chances of reeling in and moving more buyers through the sales funnel to conversion.

The Ultimate Benefit: A Flawless Client Journey

Integrating an API that is customizable and can match your company’s branding can provide your business with added value and a critical competitive edge. Buyers can go through the checkout process smoothly and securely. This, without ever experiencing disruptive ‘hiccups’ such as pop-ups or redirects that frustrate clients into abandoning their carts.

As a result, their journey on your website will be experienced as more positive, improving your success rate. The more flawless your client journey is today, the more likely you are to witness repeated purchases and returning customers.

As such, a simple investment in a payments API today will go a long way towards your business’ growth tomorrow.

Bottom line

Payments APIs enable businesses’ branding to remain consistent across their website. They also help promote a flawless client’s journey that takes buyers through the checkout process quickly, seamlessly, and ‘hiccup-free.’

Integrating a payments API is the client experience enhancer all businesses can benefit from, and use as a springboard for growth.

Selecting the right API for your business will be the smart decision that propels your brand forward in 2021. Visit the Praxis Cashier website and learn about our services to start on your journey towards the ultimate client journey today!