For online merchants operating across multiple markets, payment complexity is one of the biggest barriers to sustainable growth.

Whether you're operating an iGaming platform, expanding a retail trading business globally, or scaling any online business operation, your payment systems play a much bigger role than just facilitating transactions. They directly impact your conversion rates, customer experience, operational efficiency, and ultimately, your bottom line.

However, many businesses today still rely on outdated payment setups or single-PSP solutions. These come with challenges that create bottlenecks and limit global expansion, leaving revenue on the table.

Payment Orchestration Platforms like Praxis Tech solve this by providing merchants with the infrastructure needed to optimize their global payment operations.

What is a Payment Orchestration Platform?

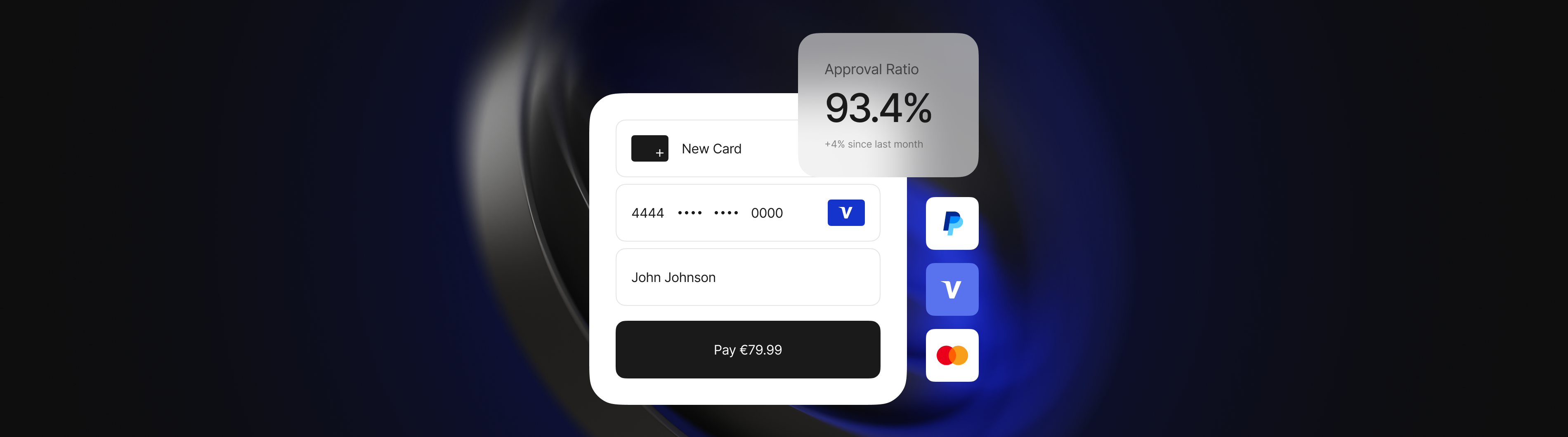

A Payment Orchestration Platform is a centralized system that manages the entire online payments process. Instead of relying on a single Payment Service Provider (PSP), businesses can connect to multiple PSPs, alternative payment methods (APMs), and fraud tools - all through a single integration and at a much faster speed than integrating with each one independently.

This unified approach eliminates the complexity of managing multiple payment integrations while maximizing transaction success rates.

At Praxis Tech, we’ve created a platform that helps businesses streamline, optimize, and future-proof their payments infrastructure. Our orchestration platform allows merchants to:

- Route transactions intelligently

- Increase approval rates

- Reduce fraud without adding friction

- Access real-time analytics

- Expand faster into global markets

For merchants serious about global expansion and revenue optimization, payment orchestration has become essential infrastructure.

Why Businesses Need Better Payment Systems for Online Payments

Single-PSP setups may seem simpler, but they create significant limitations for growing businesses.

Different PSPs excel in different areas. One might have better approval rates in Europe, while another might be more reliable for mobile payments in Asia. When one goes down or underperforms, however, a merchant’s entire checkout process can suffer.

Beyond that, managing different integrations, compliance processes, and data sets across providers creates unnecessary complexity. It slows teams down, makes financial reporting harder, and increases the risk of errors.

Successful online businesses require payment systems that are resilient, adaptable, and built to support growth. That’s exactly what a Payment Orchestration Platform provides.

Smart Payment Routing: Maximize Your Approval Rates

Every failed payment is a potential lost customer. Most businesses accept declines at face value, but Smart Routing provides a more optimized solution. This feature allows the orchestration engine to automatically redirect a transaction through a different PSP if the first attempt fails.

It can also choose the optimal PSP based on criteria like:

- Customer location

- Currency type

- Historical approval rate

- Card type

This not only improves your approval rates but also ensures a more consistent customer experience. Praxis Tech’s routing engine is built to dynamically evaluate transaction success patterns and direct traffic where it’s most likely to succeed. When declines happen, our Decline Recovery tools can automatically retry payments, improving results.

Improved Conversion Rates at Checkout

Checkout is where customers make their final decision, and the smallest friction point can cause drop-off. Maybe the right local payment method isn’t available, or maybe the PSP is experiencing downtime. Whatever the cause, a clunky or failed payment experience leads to lower conversion rates.

A Payment Orchestration Platform like Praxis Tech improves checkout conversion by:

- Presenting familiar and trusted local and global payment options

- Reducing transaction failures through Smart Routing and Decline Recovery

- Supporting one-click deposits through tokenization for returning customers

At Praxis Tech, we help businesses tailor the checkout experience to their users - whether that’s PayPal, Apple Pay, Sofort, PIX, or hundreds of other alternative payment methods.

Optimized checkout experiences directly translate to higher conversion rates and improved customer retention.

Creating The Perfect Checkout Experience for Higher Conversion Rates

Centralized Payments Reporting and Analytics

A key challenge when managing multiple PSPs is reviewing performance data.

Businesses accepting online payments need to quickly identify the number of declined payments they had this month, compare their approval rates in one region to another, or determine their abandonment rates.

With centralized reporting and analytics, merchants gain real-time access to the answers - all in one dashboard.

Instead of jumping between PSP dashboards, everything is consolidated through the Payment Orchestration Platform. That means:

- Quicker reporting cycles

- Easier trend analysis

- Comparative performance metrics

- Simplified financial reporting

Praxis Tech gives merchants access to detailed, real-time data across all providers, methods, and geographies - enabling proactive optimization rather than reactive troubleshooting.

Faster Market Expansion with Local Payment Methods and PSPs

Global expansion requires merchants to navigate complex PSP landscapes and diverse regional payment preferences.

Each country has its own payment habits. If a business is not offering local payment methods, it risks alienating customers before they even reach the checkout.

This is where a Payment Orchestration Platform provides a massive advantage.

Merchants can connect quickly to new PSPs, test new regions, and launch new payment methods - all without building individual integrations or slowing down development roadmaps.

Praxis Tech supports hundreds of integrations, giving businesses the power to:

- Offer localized checkout experiences

- Speed up regional launches

- Boost acceptance with market-specific PSPs

Our platform handles integration complexity, allowing development teams to focus on core business features rather than payment infrastructure.

Enhanced Fraud Management

Effective fraud prevention requires balancing security with customer experience to avoid blocking legitimate transactions.

An effective fraud management strategy strikes the right balance between protection and performance.

Through orchestration, merchants can integrate multiple fraud tools (such as 3DS, AI-based scoring, and rule-based engines) and apply them dynamically based on:

- Transaction size

- Country of origin

- Payment method

- Risk profile

This layered, flexible approach allows businesses to reduce fraud while keeping friction low.

At Praxis Tech, we offer Praxis Safe - a full-featured fraud management solution that uses machine learning and adaptive risk scoring to identify threats and flag suspicious patterns.

Whether merchants need to fine-tune filters or route high-risk payments differently, our system puts them in control.

Understanding and Preventing Chargeback Fraud

Payment Optimization Through Orchestration

Payment optimization is key to unlocking more revenue and improving the customer experience. With a payment orchestration platform, merchants can route transactions through the most effective providers - boosting approval rates and reducing the number of failed payments.

Instead of relying on a single PSP, smart routing technology automatically selects the best-performing option based on location, card type, or real-time performance data. This level of payment optimization helps ensure that more transactions go through successfully. Businesses connected to Praxis Tech can also utilize our AI Smart Routing feature, which analyzes performance and recommends changes to the PSP priority order, to deliver high first-time approvals on card payments.

Local payment methods and currency support also play a major role in payment optimization. When customers see familiar, trusted options at checkout, they’re more likely to complete the purchase – lowering abandonment rates and increasing conversions.

Beyond the customer-facing benefits, orchestration simplifies backend operations. Centralized reporting and real-time analytics give operations teams complete visibility, enabling them to spot inefficiencies, adjust strategies quickly, and continuously optimize payment performance.

Overall, payment optimization through orchestration improves approval rates, streamlines processes, and supports long-term growth.

Connect to Praxis Tech’s Platform

At Praxis Tech, we provide merchants with comprehensive payment optimization solutions. Our Payment Orchestration Platform is designed to reduce complexity, increase revenue, and give merchants full control of their payment strategy.

Key capabilities include:

- Connecting with global PSPs

- Offering local payment methods

- Improving conversion rates through seamless checkout experiences

- Accessing powerful centralized reporting and analytics for better decision-making

- Routing payments dynamically to maximize approval rates

- Enhancing security with our advanced fraud prevention suite, Praxis Safe

Our platform provides agile, secure, and scalable payment infrastructure. Get in touch to learn how Praxis Tech can optimize your payment operations and boost conversion rates.