1-click checkout is just as convenient as it sounds – customers only need to click once to make a purchase. Convenience leads to fewer abandoned carts, more revenue, and happier shoppers.

This guide will go over what 1-click checkout is, if it’s right for your business, and how to offer it to your customers.

What is a 1-click checkout?

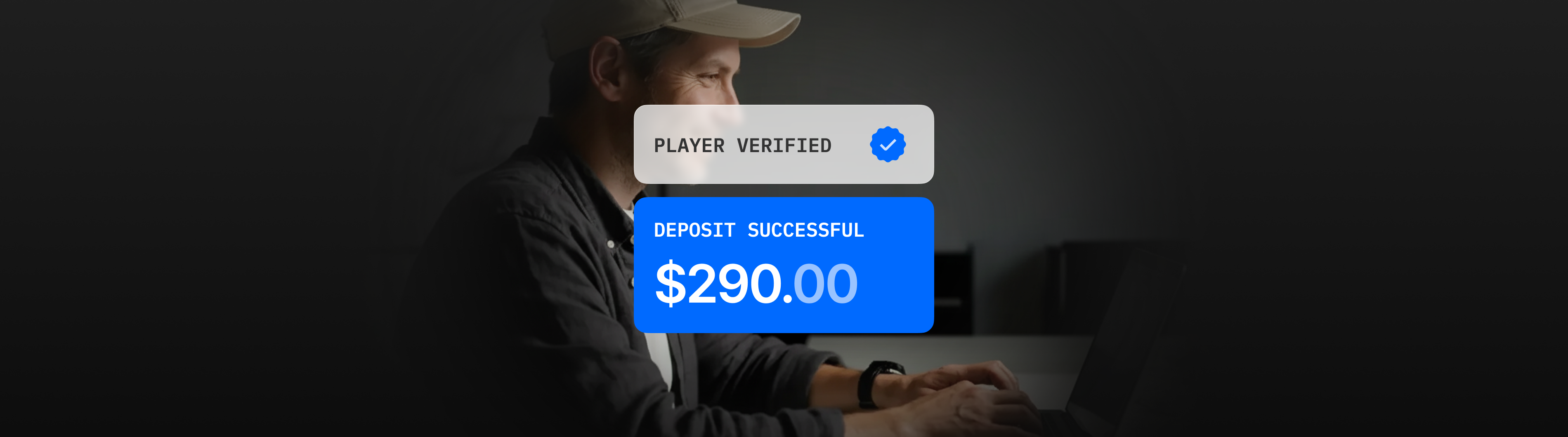

With 1-click checkout, customers only need to enter their payment info once. Their info will then be securely stored for future use. When buying from a store that has implemented one-click payments, you can simply click (or tap) once and the purchase will go through.

Amazon had exclusive use of 1-click checkout until their patent expired in 2017. So now Merchants everywhere are adopting 1-click checkouts! Does that mean you should also move towards one-click payments?

Here are some things to consider.

What are the benefits of 1-click checkout?

Shoppers are spending online more than ever, whether it’s making a deposit or buying from an e-commerce store. Unfortunately, nearly 70% of carts end up being abandoned! You can significantly raise your revenue if you can save even a fraction of those carts from being abandoned – integrating 1-click checkout is one quick and easy way.

Easy payments & purchase cancellation

These days, regular customers who have already made a transaction before often expect their details to be saved for their convenience. If you don’t offer convenient payment options on your checkout page, your competitors will have that edge.

It’s not fun to think about customers making a purchase and immediately wanting a refund or cancellation – but giving them the ability to do so can actually improve customer trust in your business.

An online payment gateway can also give shoppers a few minutes of breathing room during which they can cancel the transaction without worry. You might also want to offer a proxy screen where customers are asked “Are you certain you want to buy ___?” when they tap “Buy now”. These are good ways to prevent payment disputes and chargebacks.

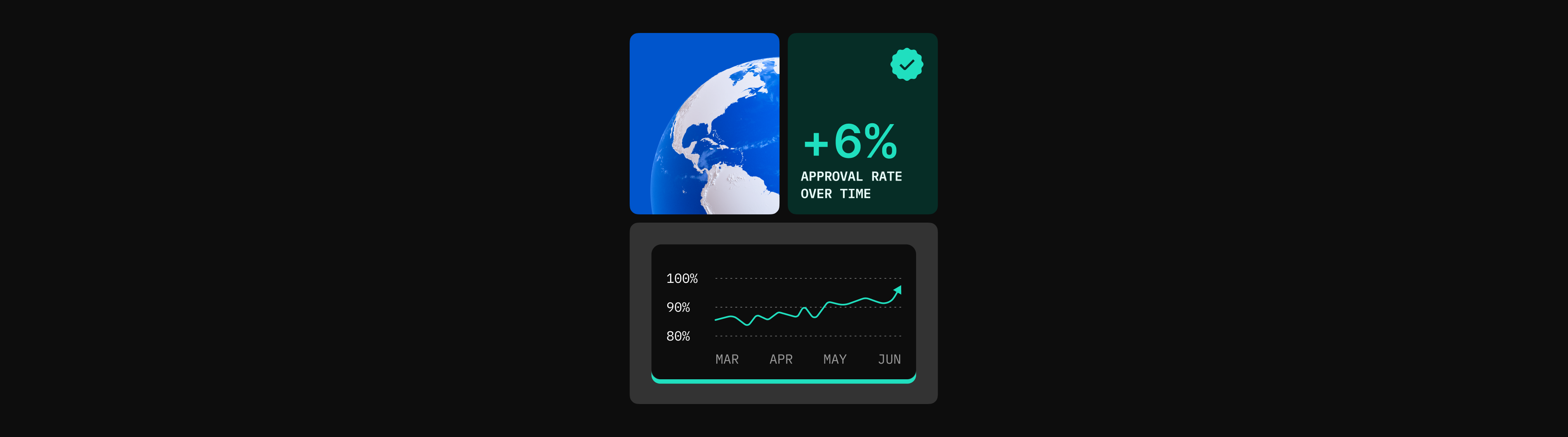

More reliability

In emerging markets where internet infrastructure is unreliable, a time-out might even prevent the purchase from being completed. A one-click payment option can help customers overcome time-outs by speeding up the process.

Flexibility & control

With Praxis Tech’s help in integrating 1-click payments, you gain control and customization of your system. A digital payment system means better peace of mind over all purchases and deposits, from tracking payment details to managing previous transactions.

Security & tokenization

Digital checkouts are all protected by Payment Card Industry (PCI) compliance or Data Security Standards (DSS). These guidelines prevent fraud and sensitive data breaches.

Tokenization tech is what allows digital payments to be safely made. The payments provider captures customer payment details and replaces those with an encrypted token, which will be used when they go through with a 1-click buy. This means that your business doesn’t have to shoulder the responsibility of keeping that data safe.

Praxis Tech is fully PCI compliant. Our team can help you optimize and customize your checkout page for maximum conversions and customer satisfaction.

Stay on the page

It’s critical to keep the customer on your site. The moment they leave, such as when redirected to a different URL, it’s highly unlikely that they’ll return. A lot of times, customers leave even when still waiting for your page to load, which is why speed optimization is so important.

A 1-click payment option allows you to cut the redirect and host the entire payment on your site: fast, easy, and secure.

Is 1-click checkout right for your products?

Impulse purchases

1-click checkouts encourage impulse purchases, especially for e-commerce businesses that sell low-ticket items or finance companies that offer a straightforward service.

For example, if you sell relatively small products, like eye-catching novelty items or snacks, 1-click payments are excellent and beloved by customers.

A/B test your payment page

If you’re unsure whether your checkout is better with 1-click payments, you can perform A/B testing by presenting 2 versions of your page to different customers. Group A sees one-click checkout, Group B uses your usual offered checkout method. Compare the results using conversion analytics to see what improvements you can make.

Security concerns

It’s notable that in some markets, one-click payments can undermine the perceived security of the transaction. Your business can prevent customer distrust by displaying security icons and clearly explaining your data protection policy. Providing swift customer service and purchase cancellation options can also boost customer experience and trust in your brand.

Mobile vs Desktop

Over 50% of internet traffic is mobile. You can perfect and personalize your checkout page to your business’s content, but the checkout flow needs to be optimized for different devices. Sometimes, 1-click payments can be preferable for mobile users whose devices have smaller screens. You may need an A/B test to figure out whether you should use 1-click for mobile only, and not for desktop.

Optimize your checkout today!

Praxis Tech offers personalized and professional checkout and payment services. Whether you’re an eCommerce business looking to sell more products or a Finance Company seeking higher conversion rates, we can tailor your payments page just for you.