New year, new me – new consumer behavior. New year’s resolutions emphasize health, fitness, hobbies, living better, and more. These have a huge impact on how people spend their money across various markets. Engage with these resolution-related trends and you can gain useful and lucrative insights into your target customers.

Let’s dive into new year’s resolutions and consumer behavior.

What are New Year’s Resolutions?

At the start of a new year, it’s very popular to make a vow to do certain things better this year. It’s often health related, like going to the gym more or quitting smoking. The point is, people want change, whether that’s in their routine, actions, or otherwise. Because of this, consumers are more willing to try out new products and services.

Here are some of the most common resolutions people make:

Fitness goals

People flock to the gym at the start of every year. Sure, the number tapers off over time, but if you sell products and services for losing weight, this is the perfect time to invest in marketing. Even just fitness-adjacent products can see an influx of new customers who want to try to become healthier.

Make healthy food at home

Holiday shopping is expensive. November and December often involve a ton of food-related purchases. That number sharply plummets after the new year as people seek to save on food expenses by making food at home by themselves.

Reduce carbon footprint

Consumers have embraced environmentally friendly campaigns in recent years. Going green is a great initiative that many consumers want to undertake. The solar power industry in particular has greatly benefited from people caring more about climate change and pollution. It is projected to grow to more than USD$1.1 billion in revenue.

Your business can also find tips on how to go green with Praxis.

Quit a bad habit

Your product or service doesn’t have to be for doing something to profit off the surge in resolutions. It can also be to stop something, like no longer drinking soda or quitting alcohol.

Quitting smoking is a bad habit that millions of people want to quit every year for their new year’s resolution. Sales from smoking cessation products are expected to reach $1.2 billion by 2017.

Try a new hobby

New hobbies often see surges in interest around the new year. Many people want to get into new social groups and make new friends, whereas others just want to try out something new. If your business can cater to new hobbyists in the first few months of a year, you may see increased revenue!

Tap into the resolution craze

99% of consumer respondents said in a study that a product sample helped them reach their resolution. That is an incredible percentage of people who are open-minded and willing to try out new products just to help them reach their goals for the new year. This makes it the perfect time to get your product into the consumer’s hands during this decision-making timeframe.

It’s important to tap into the resolution craze as early in the new year as you can, though. The success/failure rate of new year’s resolutions doesn’t look so hot after the first 6 months, after which a majority of people feel like they’ve failed.

How much do consumers pay for resolution results?

25% of consumers responded to a study that they are willing to pay whatever it takes to see results for their new year’s resolutions, whereas 33% of respondents set a maximum budget of $50. Another 18% say they will pay up to $100. As you can see, it’s a great opportunity for businesses to pique the interest of customers they may not usually target.

How do financial resolutions impact consumer behavior?

66% of Americans plan on making financial new year’s resolutions. Understanding financial resolutions can give you an extra edge over your competitors, because they can alter how you position your products and services towards your target market. Financial resolutions vary quite a lot depending on the demographic.

Older generations

A generational divide has resulted in older Americans concentrating on saving for retirement. They may not be as willing to spend as much money on their new year’s resolutions because their goal is to save money.

Younger consumers

Younger consumers also save money for financial resolutions, but it is often with a goal in mind: such as to make a big, meaningful purchase or to increase their investment portfolio. Significant milestones younger consumers spend on include buying a car, paying for a wedding, and having a child.

Paying off debt

A majority of financial resolutions are usually related to paying off debt. This may impact how you position yourself if you plan on marketing towards demographics that have debt – many companies choose to offer promotions or sales to charm new customers who don’t want to break the bank when trying something new.

Saving for a big investment

Many financial resolutions regardless of age group have to do with saving up for a large buy, such as for a TV or phone. Understanding what your target market wants to do for the new year can make a difference in how much your business can save – or cash in during the first few months of a year.

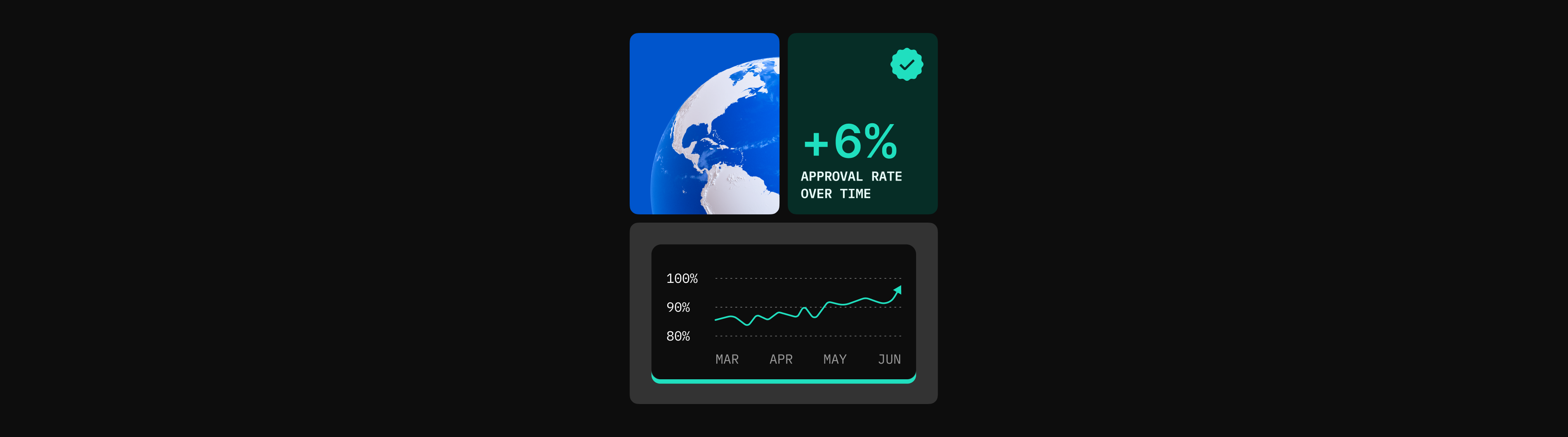

Prepare for spending

If you’ve assessed your industry and what you do and have a feeling you can benefit from new year’s resolutions (which you probably can!), it’s essential that your checkout services provide an excellent payment experience for new customers. You want the customer journey to be simple, intuitive, and convenient. Consumers are willing to pay a lot to reach their new year’s goals, but they are also likely to abandon a cart if it takes too long to pay.

Reach out to our team to make your online payments process smooth and seamless today! Our experts can make you a boutique cashier that caters to your business needs. We also offer ways to help you simplify and save on your transactions.