Gaming platforms processing hundreds of thousands to millions of transactions annually across multiple regions rely on payment infrastructure to deliver the deposit experiences their customers expect, support expansion into new markets, and maximize revenue from every transaction attempt.

At this scale, payment operations demand precision and agility. In-house payment teams must be analytics-driven and focused on managing their systems efficiently, ensuring multi-currency and multi-payment method transactions are completed successfully and are tailored to each customer’s location and preferences. Much of their time is spent on managing processor relationships, scaling infrastructure alongside business growth, and maintaining strong approval performance across every region.

Why Gaming Merchants Choose Payment Orchestration

Large gaming operators increasingly rely on payment orchestration platforms to serve as the integration layer between their platform and the processors that handle their transactions. This approach addresses several operational challenges at once.

Access to a Global Processor Ecosystem

By connecting to a payment orchestration platform experienced in the gaming industry, operators gain access to an ecosystem of hundreds of pre-integrated processors. Many of these providers offer solutions tailored specifically to the gaming industry, with experience handling high transaction volumes, regional payment preferences, and have the payment standard certification requirements that come with operating in regulated markets.

Rather than building and maintaining individual integrations with each processor, merchants connect once to an orchestration platform and can then activate new providers through configuration. This removes the technical overhead that typically slows expansion.

Faster Regional Expansion and Stronger Local Performance

Payment orchestration also supports gaming operators in scaling into new regions and strengthening performance in existing markets.

When scaling to new regions, operators can quickly activate local processors and payment methods that their customers expect to use in those regions. This accelerates time-to-market and removes barriers that would otherwise delay launches.

In markets where operators are already established, connecting to additional local processors through orchestration layers also creates resilience and optimization opportunities, including:

- Cascading functionality automatically redirects initially declined transactions through alternative providers, recovering deposits that would otherwise be lost

- Expanded processor coverage gives customers more ways to fund their accounts through broader payment method support

- Increased resilience with multi-processor setups protecting against processor downtime or technical issues affecting transaction flows

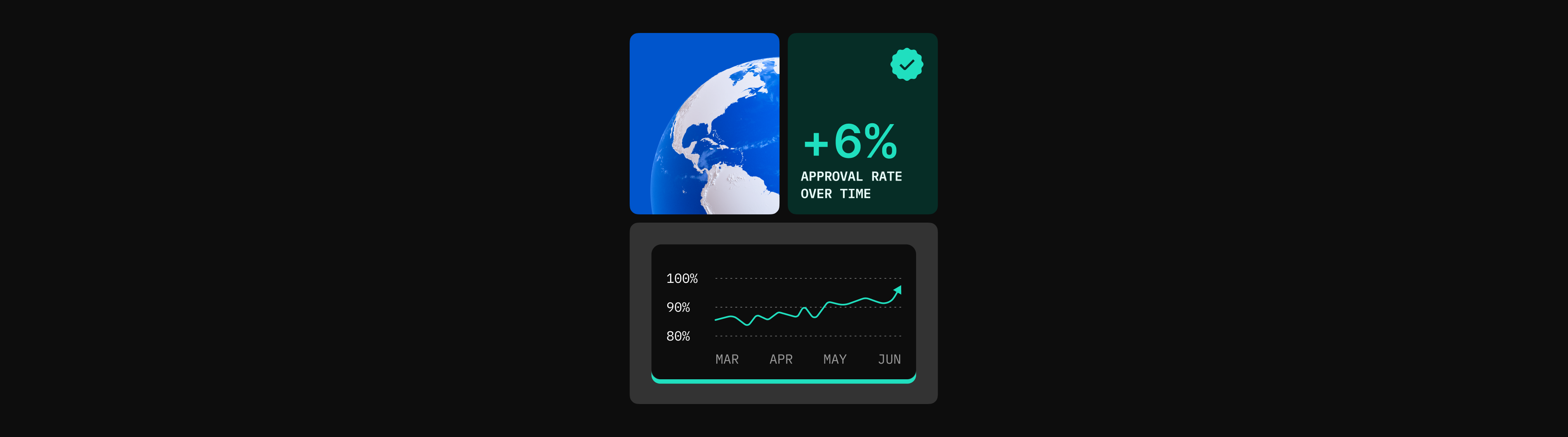

- AI Performance-based routing supports merchants to direct transactions to the processors most likely to approve them, boosting overall approval rates

- Centralized reporting consolidates transaction data from all processors into a single dashboard, giving payment teams unified visibility to compare performance and identify optimization opportunities

The 5 Things Businesses Do When Connecting to a Payment Orchestration Platform

Maintaining Modern Payment Standards

Payment orchestration platforms also help gaming merchants stay current with evolving payment standards and offer more ways for customers to pay for in-game experiences. Examples include:

- Subscription-tiered premium accounts that unlock additional features or benefits

- Automatic balance top-ups when a customer’s account falls below a threshold they set

- One-click payments that keep users engaged in gameplay rather than spending time on deposit pages

These capabilities rely on secure card vaulting and tokenization, which orchestration platforms manage on behalf of merchants while maintaining PCI DSS compliance.

Branded, Responsive Payment Experiences

The deposit page itself is an important stage that builds customer trust. For gaming merchants, these pages need to feel like an extension of the game, not a generic checkout form.

Payment orchestration platforms allow operators to customize and brand their payment interfaces. Equally important, they enable responsiveness to seasonal promotions, time-limited offers, and welcome bonus events that are central to player acquisition and retention in gaming. When a new campaign launches, the payment experience can adapt without requiring additional development work.

Building Payment Infrastructure for Scale

For gaming operators processing high volumes across global markets, payment orchestration provides the infrastructure needed to scale efficiently. It reduces integration complexity, improves transaction performance through intelligent routing and decline recovery, and delivers the flexibility to adapt payment experiences as the business evolves.

Praxis Tech offers a payment orchestration platform built for the demands of enterprise gaming operations. With access to hundreds of pre-integrated processors, AI-powered routing optimization, recovery and payment retry tools, and customizable deposit interfaces, Praxis helps gaming merchants increase approval rates, expand into new markets faster, and deliver the payment experiences their customers expect.

Get in touch to learn how Praxis can support your payment operations.