Before BDCC: The Struggles of International Transactions

Let’s face it: international transactions can be extremely difficult. You must not only consider shipping and customs fees, but also the perilous world of currency conversion. It can be difficult to calculate the exchange rate on the fly, and you don’t want to overcharge or undercharge your customers.

Customers may be confused if prices and charges are displayed in a currency other than their own. They might be oblivious to how much they’re paying or why the amount on their credit card statement differs from what they thought they paid. If they don’t recognize a charge on their statement, they may file a chargeback or dispute, which can be very inconvenient for you.

But don’t worry, there’s a solution: BDCC!

After BDCC: The Benefits of Offering BDCC

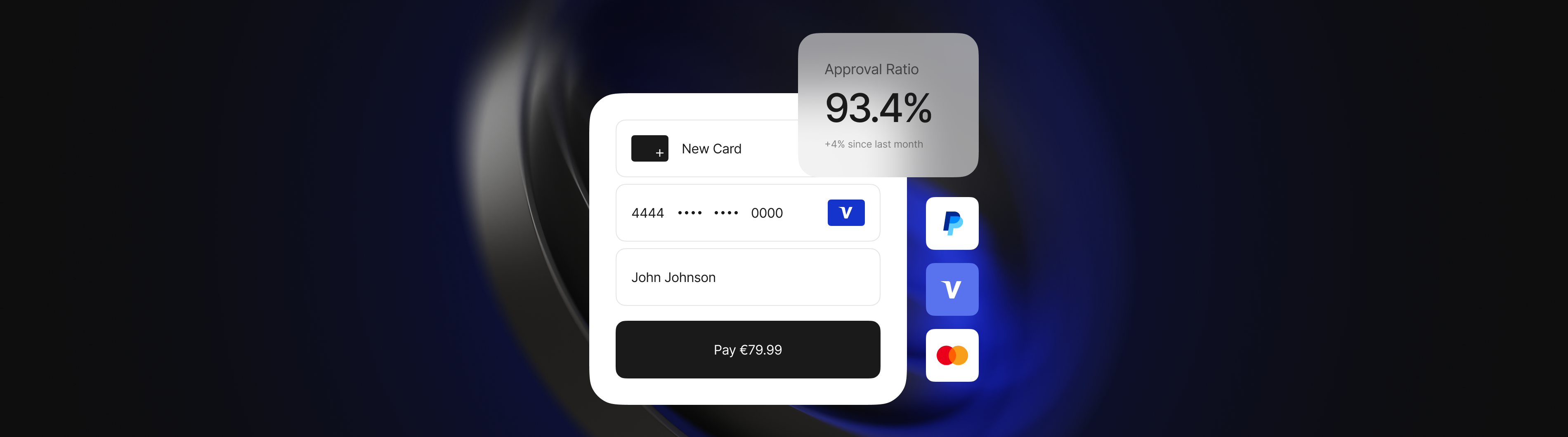

BDCC, or background dynamic currency conversion, can be a game changer for merchants. Customers can pay in their own currency with BDCC, making the payment process much easier and more transparent. Customers will be able to see the exact amount they are paying in their home currency converted to the processing currency based on market exchange rates.

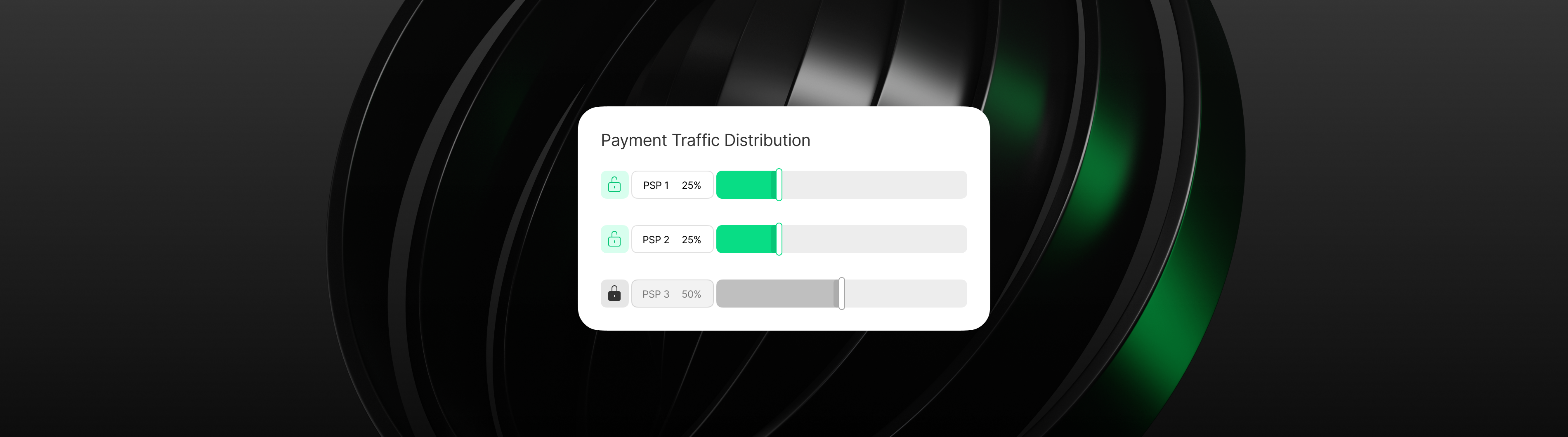

But that’s not all; with Praxis Tech’s BDCC, we’ve gone above and beyond to help you save money on potential revenue loss. With BDCC enabled, transactions can now be converted in the background into a supported currency. This results in more approved transactions, more revenue for the merchant, and a better overall customer experience.

By providing BDCC, you can also reduce the risk of chargebacks and disputes. Customers are more likely to recognize and approve charges displayed in their own currency, saving you the headache of chargebacks caused by unfamiliar exchange rates or charges. This means fewer squabbles and more time to focus on growing your business.

Offering BDCC can provide you with a competitive advantage while also reducing risk. Customers are more likely to shop with merchants who offer straightforward payment options. By providing BDCC, you can attract more international customers and increase sales.

So, how do you get started with BDCC?

How to Start Offering BDCC

Begin using Praxis! We’ll work with you to integrate BDCC into your checkout process so that customers can pay in their native currency.

We’ll help you understand any fees or charges associated with BDCC before you sign up, and we’ll make sure you’re in compliance with all relevant regulations and laws pertaining to currency conversion and international transactions.

You’ll be able to offer a simpler, more transparent payment process to your international customers once you’re set up. You will be able to attract more customers from all over the world while decreasing the likelihood of chargebacks and disputes. It’s a win-win situation for everyone!

Conclusion

International transactions do not have to be challenging. By providing BDCC, you can simplify the payment process, reduce risk, and improve the customer experience. You’ll be able to focus on growing your business while providing convenient and transparent payment options to your customers.

So, what are you waiting for? Begin offering BDCC right away!