Chargeback: it’s a word that strikes fear deep in the heart of every online retailer or service provider and for good reason. Aside from being a huge hassle and time drain, chargebacks cost businesses a whopping $80+ billion annually.

This is bad news beyond even the loss of cash and merchandise — in many cases, a merchant’s entire relationship with financial institutions can be jeopardized by too many chargebacks.

Therefore, it’s critical for business owners who rely on payment processing as their bread and butter to learn how to avoid chargebacks, to begin with, ideally preventing them entirely. We’ve compiled a few tips to help you do exactly that. Read on for more information on preventing chargebacks and increasing your e-shop profits.

Step 1: Deal with Customer Service Issues Promptly

We get it. Dealing with unpleasant things like negative customer feedback has a way of getting pushed off until the last minute.

To avoid chargebacks, you must resist the urge! ‘Friendly fraud’ is responsible for 77% of unauthorized transaction claims, and it’s usually completely avoidable.

In addition, friendly fraud occurs when customers haven’t received prompt attention for their issue and incorrectly use the chargeback process out of impatience.

Step 2: Spot Signs of Fraud Early

To minimize your chargeback ratio, train employees to recognize the telltale signs of shady business. Some examples include:

- Large purchases made immediately after small ones

- Charges from multiple accounts that have different email addresses but the same IP

- Clearly fake email addresses

- Customer messages that seem scripted or generic

- Repeated purchases to the same email address from different credit cards

- The same card used for multiple items to different physical addresses

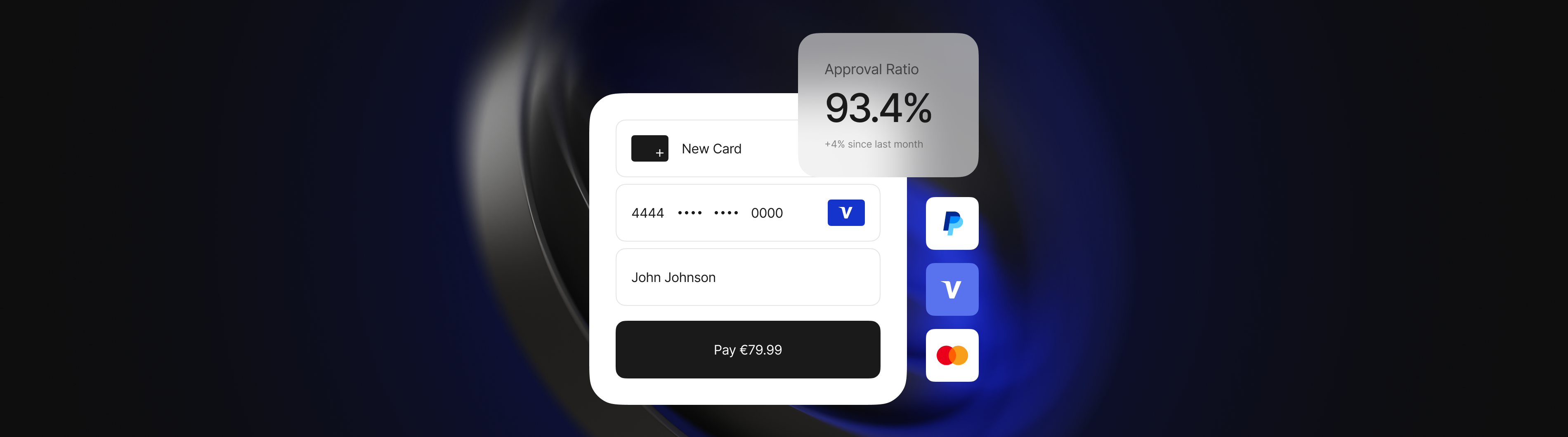

Step 3: Offer Multiple Payment Solutions

Offering the choice of payment system that works best for customers guarantees the highest possible success rate.

Very often, chargebacks happen because a client did not recognize a particular payment service provider simply due to it not being commonly used in their particular country.

Lastly, the more payment options you can offer to your clients, the better the chances of platform familiarity on their part. This minimizes the likelihood of chargebacks caused by customer confusion or lack of awareness.

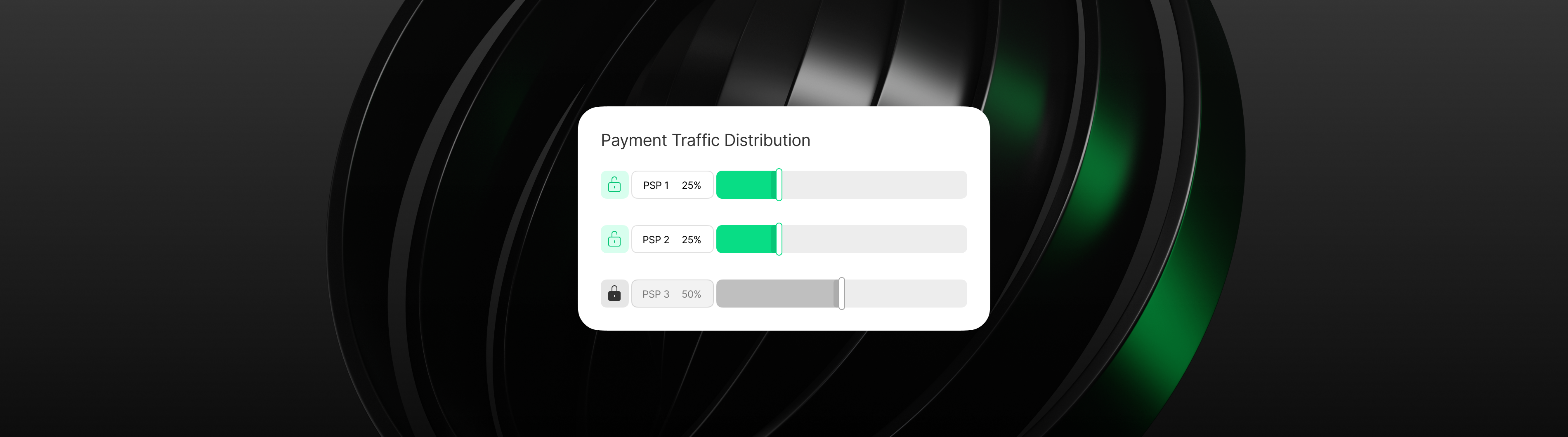

Step 4: Detailed Customization of Preselected Rules

Preselected rules allow the merchant to control payment method and platform options for particular populations.

Aligning payment options with local norms can make a huge difference in the ease and convenience of customer payments —preventing chargebacks before they happen. For instance, the great majority of payments across Africa are carried out over mobile.

Similarly, establishing mobile-only rules in Africa will ensure that only the most commonly used and historically successful payment options are available.

Step 5: Smart Routing to Avoid Chargebacks

Smart routing utilizes algorithms that recognize your clients’ audience demographics and route the purchase through the appropriate PSP.

Moreover, it’ll also actively avoid PSPs that have been less effective for particular types of customer profiles. Through automated PSP selectiveness, preference is given to higher functioning platforms.

Therefore, it enables greater purchase success, minimizing your chargeback ratio.

The Conclusion

In short, chargebacks can do real damage to businesses of all sizes and types, and it makes sense that they’re feared by merchants everywhere.

Luckily, it’s fairly easy to avoid chargebacks entirely by putting the right preventative measures in place. It really comes down to merchants understanding the online payment sphere and where their customers fit in. The difference between organizations vulnerable to chargebacks and those protected from them comes down to knowledge of the right tactics — and implementing them.

Above all, we hope our suggestions will keep your business safe and prosperous!