The world is very diverse in its cultures and ways of life, but also in popular payment methods. As digitalization and online payments have taken hold, they have significantly changed the way we pay for things. Alongside the growing penetration of credit card payments, Alternative Payment Methods (APMs) have emerged as a strong force in the global landscape of digital payments. APMs refer to payment options beyond traditional credit or debit card transactions. These methods are diverse in their options, and their popularity varies from country to country, accommodating various preferences, cultures, and technological infrastructures. This article kicks off a series about Alternative Payment Methods where we will delve into different types of APMs and their popularity in different parts of the world.

First of all, APMs encompass a wide array of payment options, offering consumers and businesses flexible and convenient ways to transact. So, whatever is not a credit card or cash payment, can be classified as an APM. They can be vaguely classified as follows:

Mobile Wallets

Mobile wallet apps, such as Apple Pay, Google Pay, and Samsung Pay, enable users to store multiple payment methods securely on their smartphones. Users can make payments by simply tapping their devices, eliminating the need for physical cards. In fact, mobile wallets have gotten so popular that they have been carried over to non mobile-first payments, meaning that consumers can now use Apple Pay, for example, to pay on a desktop web browser.

Cash-Based Systems

It may seem that the world is going cashless (and in some instances it’s true), but the popularity of cash-based payment solutions used for online transactions is on the rise. These include payment vouchers or codes that can be purchased with cash and used for online payments. We will take a closer look at these systems in our upcoming articles.

Prepaid Cards

Similar to cash-based payments, prepaid cards, like prepaid debit or gift cards, allow users to load funds onto a card for future use. These cards are widely used for online shopping, gaming, and subscription services.

QR Code Payments

QR code-based payments involve scanning a merchant's QR code with a smartphone to initiate a transaction. This method is prevalent in countries like China, where services like Alipay and WeChat Pay dominate the market.

Bank Transfers

Direct bank transfers allow funds to move directly from one bank account to another. This method is commonly used for online purchases, subscription services, and bill payments.

Digital Currencies

When it comes to APMs, it is impossible to ignore cryptocurrencies. From Bitcoin and Ethereum to hundreds of others, decentralized digital currencies enable peer-to-peer transactions. Underpinned by blockchain technology, cryptocurrencies ensure secure and transparent transactions, however are prone to volatility, as well as a number of other risks.

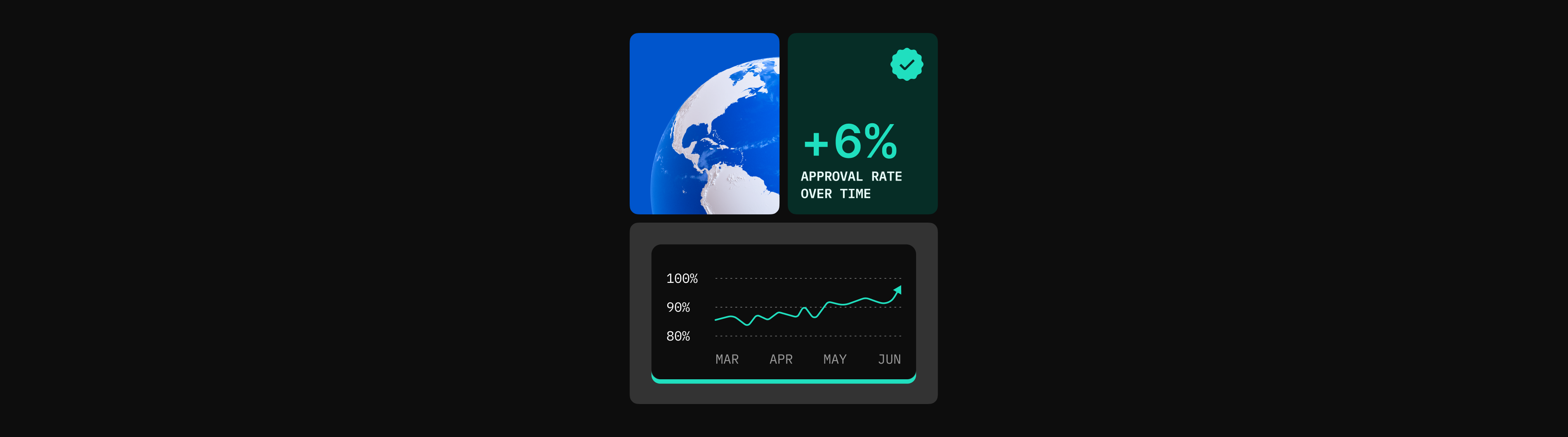

The Popularity of Various APMs Around the World

Asia

- China: Peer to Peer transfers are ubiquitous, allowing users to make payments both online and offline. The country also boasts a variety of payment applications which are popular, however limited when it comes to the industries they serve.

- India: The Unified Payments Interface (UPI) has revolutionized digital payments with their instant mobile payments, enabling seamless bank-to-bank transactions via smartphones.

- Thailand: Pompay, one of the most popular payment methods integrated offering personal or corporate QR code payments and transfers.

Europe

- Germany: Giropay facilitates secure online payments by connecting customers with their banks’ online banking systems.

- Poland: Blik - a unique 6-digit code, which you will find in your bank's application and need to enter on the Merchant’s page to transfer the funds in seconds.

- Netherlands: iDEAL is a popular online payment method that links customers directly to their online banking application during the checkout process.

North America

- United States: Digital wallets like Apple Pay and Google Pay are widely used, allowing contactless payments in stores and apps.

- Canada: Interac e-Transfer enables secure email and text message money transfers between Canadian bank accounts.

Africa

- Kenya: M-Pesa, a mobile phone-based money transfer and payment service, is widely used for transactions and microfinancing services.

- Nigeria: Online banking is on the peak of it’s popularity offering safe and quick way to deposit the funds.

South America

- Brazil: PIX is an instant payment platform. Its popularity skyrocketed ever since its launch in 2019 making PIX the most popular payment method in the country due to the quick execution of payments and transfers.

- Colombia: PSE or the system of secure online payments unites all the banks in Colombia for easy and convenient flow for payers and payees alike.