Online merchants who cater to a global customer base have to optimize their payment acceptance operations to meet the diverse transactional preferences of international customers. One of the most significant hurdles they face is incorporating the ability to accept multiple currencies at checkout, with many businesses losing potential sales because they can’t offer customers the option to pay in their preferred local currency. This issue is particularly pressing in industries like iGaming, where players from around the world expect a seamless and localized experience.

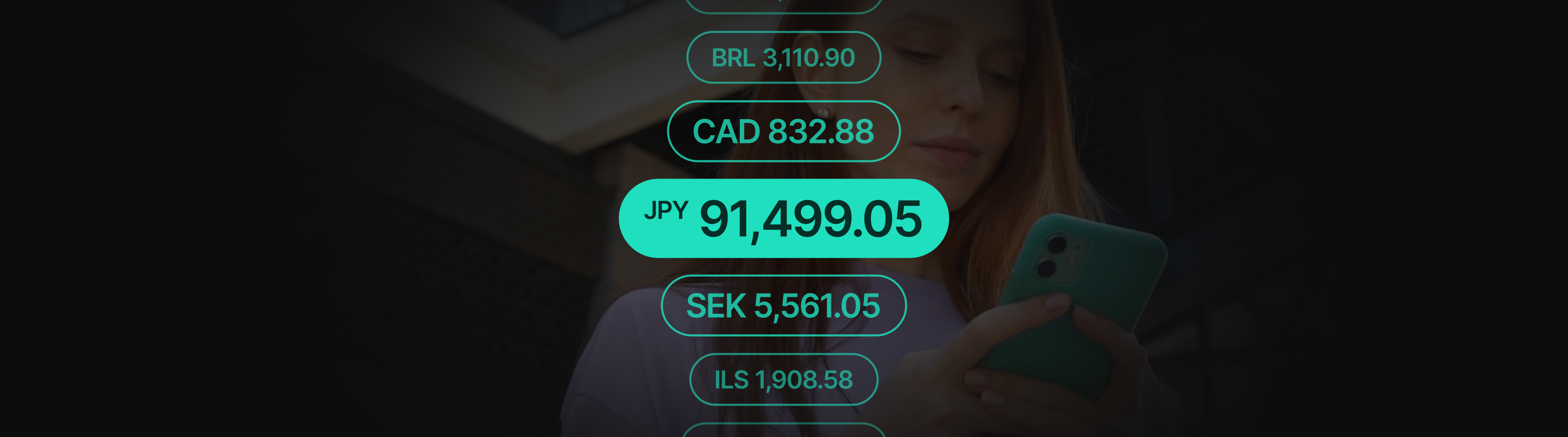

Imagine an online gaming enthusiast from Japan, whose in-game account balance is in need of a top-up before they can continue to play. They navigate to the checkout page, only to find a suggested amount displayed in US dollars. Suddenly, their enthusiasm wanes, as they’re unsure of the exact cost in yen, and the mental calculation adds friction to what should have been a smooth transaction. This scenario plays out countless times across various iGaming platforms, resulting in abandoned deposits and lost revenue.

Often, the merchant is unable to offer diverse local currency acceptance to their global customer base due to gateway or processor limitations, but there’s good news: solutions exist to help merchants expand their currency acceptance without overhauling their entire payment infrastructure.

The Power of Background Dynamic Currency Conversion

Background Dynamic Currency Conversion (BDCC) allows merchants to accept a wide range of currencies without changing their preferred payment gateway. This technology works behind the scenes, using live exchange rates to convert the customer's local currency into one that is accepted by the merchant.

Here's how it works: When a customer from, say, Brazil visits a checkout or deposit page, they see prices in Brazilian Real. When they proceed to payment, the BDCC system seamlessly converts the amount to a currency the chosen gateway supports, such as US dollars. The customer pays in their familiar local currency, while merchants receive the payment through their existing setup.

This approach offers several benefits:

- Increased conversion rates: Customers are more likely to complete purchases when they see prices in their local currency.

- Expanded global reach: Online businesses can effectively sell to customers in countries with currencies their current gateway doesn't support.

- Simplified payment reporting: Despite accepting multiple currencies, merchants still settle the payment in their preferred currency.

Praxis Tech's Background Dynamic Currency Conversion feature exemplifies this technology, offering merchants a straightforward way to globalize their checkout process without the need for multiple integrations or complex currency management systems.

Adding More Payment Service Providers

Another effective strategy for accepting more currencies is to integrate additional Payment Service Providers (PSPs) into merchant payment operations. Each PSP typically supports a different set of currencies and payment methods, so by adding more providers, online businesses exponentially increase their ability to accept and process multi-currency transactions.

However, integrating multiple PSPs traditionally has been a time-consuming and costly process, with each integration typically requiring significant development resources and coordination between the merchant and the PSP. This can lead to lengthy project timelines and delayed market entry.

This is where innovative solutions like Praxis Cashier come into play. Praxis Cashier is an all-in-one checkout solution that enables merchants to quickly integrate with new PSPs. It offers instant time-to-market integrations with a wide range of payment providers from across the globe, allowing online businesses to quickly expand their currency and geo-relevant alternative payment method offerings.

The Path Forward

As more and more Software as a service (SaaS) online businesses expand their operations to a global audience, the ability to accept multiple currencies and offer localized payment methods is becoming increasingly crucial. Solutions like Background Dynamic Currency Conversion and all-in-one checkout platforms are making it easier to more efficiently expand their global reach without the traditional barriers of complex integrations and high costs.

By implementing these solutions, merchants are not just solving a currency problem – they’re opening doors to new markets, improving customer experience, and ultimately driving growth for their business.

Get in touch with Praxis Tech to learn more about optimizing your checkout and deposit pages for multi-currency payments to cater to the needs of a global consumer base.