Did you know that Central Bank Digital Currencies (CBDCs), which are basically digital cash, can’t be counterfeited, can be tracked, and may even be programmed to expire by a certain day and time, giving an economy a much-needed consumer spending boost at precisely the right time?

These digital currencies also pose a challenge to fintechs, payment processors, and threaten the petty cash reserves of big banks while competing against the decentralized cryptocurrency market at the same time.

There’s clearly a lot to unpack here, and this week’s Praxis Times seeks to tell merchants all they need to know about what CBDCs are, what the big players are thinking, and how this will change the way online businesses’ customers facilitate their digital payments. Sooner than later.

What are CBDCs?

Quite literally, digital cash. They are a digital form of a country’s fiat currency that will be issued by monetary institutions just as easily as they currently print physical money. Think digital euros, a digital pound sterling, a digital dollar, or even as is already in circulation in China, a digital yuan.

And while their value would be the same as the physical cash already circulating in an economy, this form of money is fundamentally different from that held within your bank’s account balance. When you pay using your credit card or use apps like Apple Pay, Google Wallet, or PayPal, you’re just moving money around electronically. CBDCs, on the other hand, are quite literally cash turned into computer code.

This means that just like the cash hidden under your mattress, you can sleep tight knowing it’ll still be there in the morning. The same is not completely true for the money held in your bank account, which your bank guarantees will be there.

So, wouldn’t a digital currency cause a bank run?

Why would you risk storing money in a bank account if you can safely store it in your Central Bank-issued digital wallet? Good question. And this is why former US President Donald Trump said a digital dollar would be “very dangerous,” claiming it would cause a situation where money suddenly disappears from bank accounts.

This is why current planning presupposes a limit on how much digital cash people can store in their wallets, with the European Central Bank (ECB) thinking somewhere around the €3000 ballpark is about right.

While this will still represent a hit for banks, as they’d lose the cheap cash flow of customer deposit current accounts, the thinking is that this won’t bring the whole financial banking system crashing down.

The State of CBDCs today

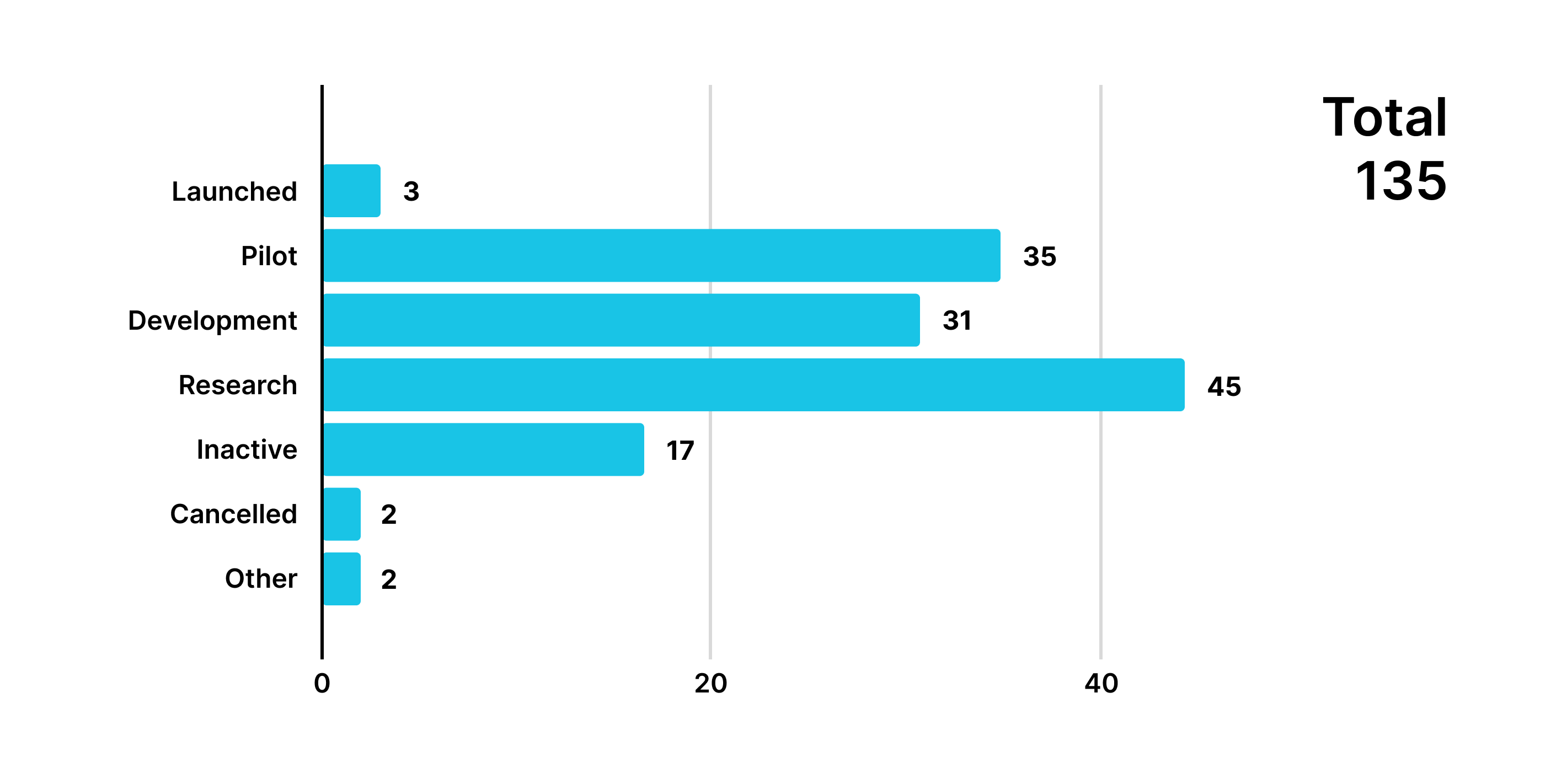

The Atlantic Council has a fantastic live tracker on CBDCs and has been keeping tabs on 134 countries that have an idea of what their CBDCs could be. Over 90% of Central Banks around the world are working on CBDCs.

China’s e-CNY pilot is leading the pack with 5.6 million merchants registered to use it across 26 cities as of last year. Other major players in the developmental stage include the Digital Euro, Digital Pound Sterling, Digital Rupee, and the Digital Dollar, which despite what was said by President Trump, has the interest of the Federal Reserve and the Biden Administration.

In March 2022, President Biden signed an Executive Order requiring agencies to think deeper on how a digital dollar would work in practice, and the Federal Reserve, in collaboration with the Massachusetts Institute of Technology (MIT) under ‘Project Hamilton’, went on to publish a whitepaper describing an OpenCBDC core processing engine that could handle 99% of everyday transaction and process 1.84 million transactions per second.

What does all this mean for payments?

One of the most exciting aspects of CBDCs is their potential to completely change the way we make digital payments. While no two CBDCs are the same, most involve instant peer-to-peer transactions, eliminating the need for intermediaries and alternative payment solutions.

China’s digital yuan, for example, completely cuts out AliPay and WeChat Pay from the settlement and processing equation, two of the most popular payment methods in the country. The European Central Bank, which entered a “preparation phase” for the Digital Euro in November 2023, has recently published a high-level architecture for payments that is entirely Account-to-Account (A2A) based.

Payment architectures like these mean lesser (or non-existent) payment processing costs for merchants and faster settlements for their customers. This does mean that payment processors and other financial institutions will have to adapt accordingly.

Did you say programmable money earlier?

Yes! Besides offering consumers payments that are just as digitally quick as handing over cash in the physical world, many central banks are expressing interest in adding programmable elements to their CBDCs too.

The Bank of England has previously expressed interest in machine-initiated payment functions, such as a parent automatically sending a child’s allowance every Monday. China has also previously also explored the option of embedding an expiry date function for its digital yuan.

The monetary and fiscal implications of programmable CBDCs would make any economist smile.

Imagine the possibilities: instead of lowering interest rates to encourage consumer spending, you can set an expiry date for the actual currency held, virtually guaranteeing a needed boost to any economy.

Traceability and Privacy Concerns

While CBDCs offer many benefits, they also raise concerns about traceability and privacy. Unlike physical cash, which is largely untraceable, CBDCs can be tracked. Governments will have a much greater ability to monitor money flows, leading to privacy concerns.

Some CBDCs, like the digital euro, plan to anonymize transactions so that while the central bank can see the money movement, it won't be linked to individuals.

This highlights a key difference between CBDCs and decentralized cryptocurrencies, which prioritize privacy and are based on decentralized blockchain systems rather than being issued by a central authority.

No, central bank digital currencies are not cryptocurrencies.

Apart from the fundamental difference in their issuing authority, CBDCs and cryptocurrencies have other distinguishing characteristics. Cryptocurrencies generally have a limited supply, as demonstrated by today’s Bitcoin halving event, while the supply of CBDCs can be adjusted based on the monetary policy of the issuing government or central bank.

There remains a huge diversity among different types of cryptocurrencies, from Altcoins, Stablecoins, and even Meme Coins, but these are fundamentally different from Central Bank digital currencies.

Key Takeaways for Merchants

CBDCs are on the horizon, and their impact on consumer payment preferences, banking institutions, and payment processing companies is expected to be significant. At least at first.

While the specifics of how their architecture functions may vary, they all offer instant payment methods for peer-to-peer, consumer-to-business, business-to-business, and government-to-government transactions, both domestically and across borders.

The implications of CBDCs on privacy are yet to be fully understood, though their mass introduction will undoubtedly usher in a new way of how we interact with money. Just like our grandparents paid in checks, our parents primarily used cash, and today we increasingly rely on online payments, the next generation will be using digital money.