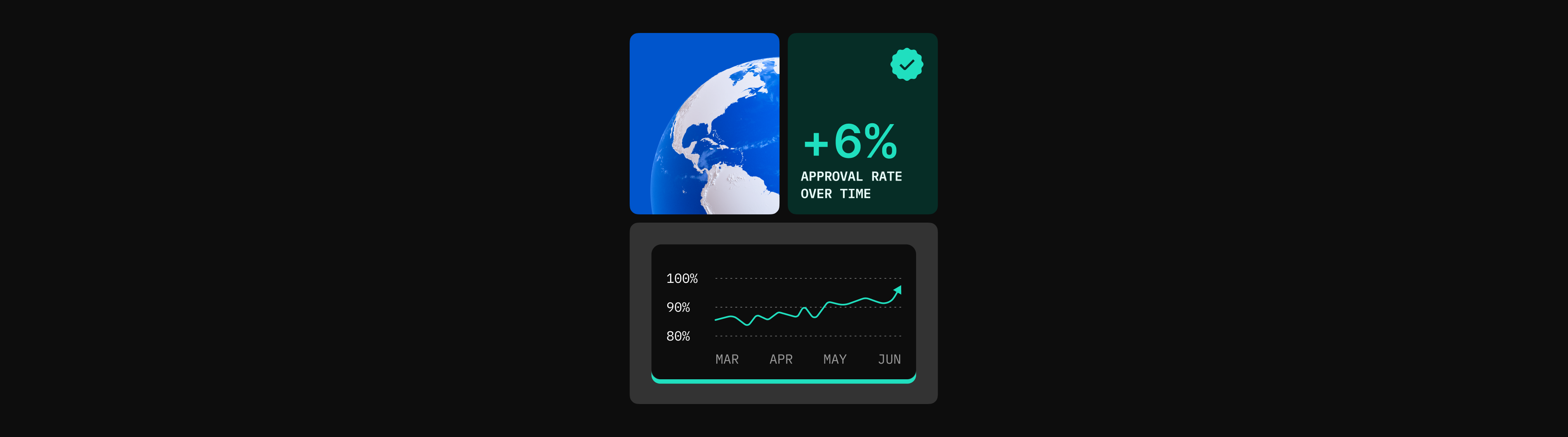

In today’s fast-paced digital world, businesses must adapt to stay ahead. At Praxis, our strategy this year revolves around decline recoveries, aiming to enhance the approval ratios of our valued merchants. We understand that maximizing revenue and improving customer experiences are vital aspects of success. In pursuit of this goal, we have developed an innovative feature called BDCC (Background Dynamic Currency Conversion), which has proven to be a game changer for our clients. In this article, we will delve into BDCC and showcase a real-life use case scenario in the iGaming industry, highlighting how we helped a merchant increase their approval ratio by an impressive 4.3%.

Enhancing Approvals, Revenue, and Customer Experiences

BDCC, or Background Dynamic Currency Conversion, can revolutionize the way merchants conduct transactions. Previously, if a gateway did not support a specific processing currency, it would be excluded from cascading, leading to a lower approval ratio and limited gateways for deposits. For instance, if a merchant had a EUR account currency but the gateway did not support EUR, it would be skipped during cascading. This not only hindered the approval ratio but also restricted the available gateways for deposit. However, with BDCC enabled, transactions can now be seamlessly converted into a supported currency in the background. This dynamic conversion results in increased approved transactions, greater revenue for the merchant, and an overall improved customer experience.

Empowering iGaming Operators in Africa

For iGaming operators, it’s difficult to accept the loss of deposits or potential new players caused by payment difficulties. In a highly competitive market, the expenses involved in acquiring new players are continuously increasing. Therefore, it is essential to guarantee smooth deposit experiences for every user. Now, let’s delve into a practical example that demonstrates the significant positive effects of BDCC.

Imagine a merchant operating in Africa, having three Payment Service Providers (PSPs) supporting local currencies, and one PSP processing in USD. The PSP handling USD is primarily used for first-time depositors, a critical group for expanding the customer base. Before implementing BDCC, the merchant faced a significant challenge. They were unable to accept local currencies, resulting in the loss of first-time depositors. This obstacle not only affected revenue but also hindered the growth potential of their gaming platform.

However, after implementing BDCC, the local currency is now automatically converted in the background to USD for processing. Once the transaction is completed, it is converted back to the local currency. This seamless conversion process allows a vast number of first-time depositors to be included in the gaming platform, unlocking substantial growth opportunities for the merchant. By enabling customers to make deposits in their local currency, the merchant eliminates barriers to entry, thereby increasing customer satisfaction and boosting revenue.

With BDCC, customers can pay in their own currency, making the payment process easier and more transparent. They can see the precise amount they are paying in their home currency, which is then converted to the processing currency based on real-time market exchange rates. This transparency and convenience empower customers, creating a positive and trustworthy relationship between the merchant and the end-user.

Conclusion

In the competitive landscape of online business, maximizing approval ratios and ensuring a frictionless payment experience is paramount. Praxis understands the challenges faced by merchants, especially in industries like iGaming. Our innovative solution, BDCC, has revolutionized decline recoveries by enabling background dynamic currency conversion. With BDCC, merchants can accept a broader range of currencies, reach a wider customer base, and ultimately enhance revenue and customer satisfaction.