For online businesses catering to a global consumer base, particularly for those in industries that disproportionately rely on repeated customer deposits such as in iGaming or retail trading business, offering the right payment methods for clients to complete their transactions in is often key to boosting conversion rates and enhancing the business's competitive advantage.

This article will outline the key considerations merchants need to make when choosing which alternative payment methods (APMs) to populate their checkout page with.

Looking for the Best Payment Options

Research has repeatedly shown that consumers will abandon their checkout if the merchant does not support the payment method they intend to use. Recent studies have revealed this number can be as high as two-thirds of consumers in some industries, and surveys recurringly underline that by offering a variety of geo-relevant and popular payment methods, merchants can very easily capture more payments that would have otherwise been abandoned, recovering potentially lost revenue and boosting conversion rates.

However, there’s no one all-encompassing perfect and universal payment method; instead, merchants must understand regional and market preferences. Different countries and regions have distinct payment method preferences, and often there are also industry-specific factors to consider.

Popular Payment Methods by Regions

When exploring payment preferences across different regions, it’s important to recognize that there’s not only a variety of specific payment methods but also different types of payment solutions altogether. These can include:

- Digital wallets that store both card and non-card payment methods

- QR Code-centric payments

- Direct bank-based and Account-to-Account (A2A) solutions

- Cryptocurrency wallets

- Mobile money services

- Cash-based voucher systems

The prevalence of these different types can vary significantly from one region to another and often reflects the local technological infrastructure. For example, mobile money services are particularly popular in Africa, whose population remains widely unbanked in some nations, whereas direct bank SEPA transfers are widely popular in Europe.

Let's explore some popular payment methods in different regions:

Top Payment Methods in Europe

SEPA (Single Euro Payment Area) payments are widely used for online purchases, bill payments and more, and similarly populations in Germany, Austria, and Belgium also use PayNow as a direct banking payment solution. Other methods, including PayPal and Apple Pay dominate when it comes to digital wallets in the region, however, there are still many localized popular methods Europeans in different countries navigate towards. This includes Giropay, which is widely used in Germany, Carte Bancaire in France, iDEAL in the Netherlands, and Bizum in Spain which has become a household name for quick transfers. Click here to read more.

Alternative Payments in South America

In a similar sense to the diversity of payment methods in Europe, South America has a wide selection of alternative methods depending on the country. For instance, PIX is the de-facto method of choice for both online and offline payments in Brazil, while Mercado Pago is widely used in Argentina. WebPay, operated by Transbank, is another popular choice widely used in Chile. Click here to read more.

Payments in Africa

Home to the planet’s youngest and fastest growing population, Africa has become the foremost global leader in mobile money adoption and alternative payment methods in this continent can be seen to be forging paths towards financial inclusion and economic growth. Services like M-Pesa in Kenya, MTN Mobile Money in Ghana, and Paga in Nigeria are all examples of popular payment solutions used. Click here to read more.

Most Popular Payment Methods in Asia

Early adopters of mobile payment systems, Asian markets propelled digital wallets to the forefront of their payment preferences beginning in the early 2010s. Omnipresent in China is WeChat Pay and AliPay, while India’s UPI (Unified Payment Interface) has truly revolutionized instant payment solutions in the country, making it the world’s most popular fast payment method. GrabPay, MoMo and ViettelPay are all also popular payment methods used throughout Southeast Asia. Click here to read more.

Advanced Payment Solutions

Incorporating geo-relevant payment methods into deposit and checkout pages will immediately provide the customer with a sense of familiarity, trust, and confidence in the online business they’re transacting with. Similarly, there are industry-specific methods that vary in popularity too. For example, iGaming customers typically use the Skrill payment method more due to their existing familiarity with the service, while retail trading clients may also choose to use their crypto wallets as payment methods. However, to truly optimize the checkout process, merchants should also consider implementing these more advanced features:

- One-click deposits: Simplify repeat transactions and balance top-ups for returning customers. This feature reduces friction in the payment process, encouraging more frequent deposits and improving user experience. Read more.

- Automatic balance top-ups: Particularly useful for iGaming, where players' account balances may need frequent replenishment. This feature ensures uninterrupted gameplay, potentially increasing player engagement and retention. Read more.

- Smart Routing: Automatically select the ideal Payment Service Provider (PSP) for each transaction, incorporating geo-specific or payment method-specific rules. This optimizes transaction success rates and may reduce processing costs. Read more.

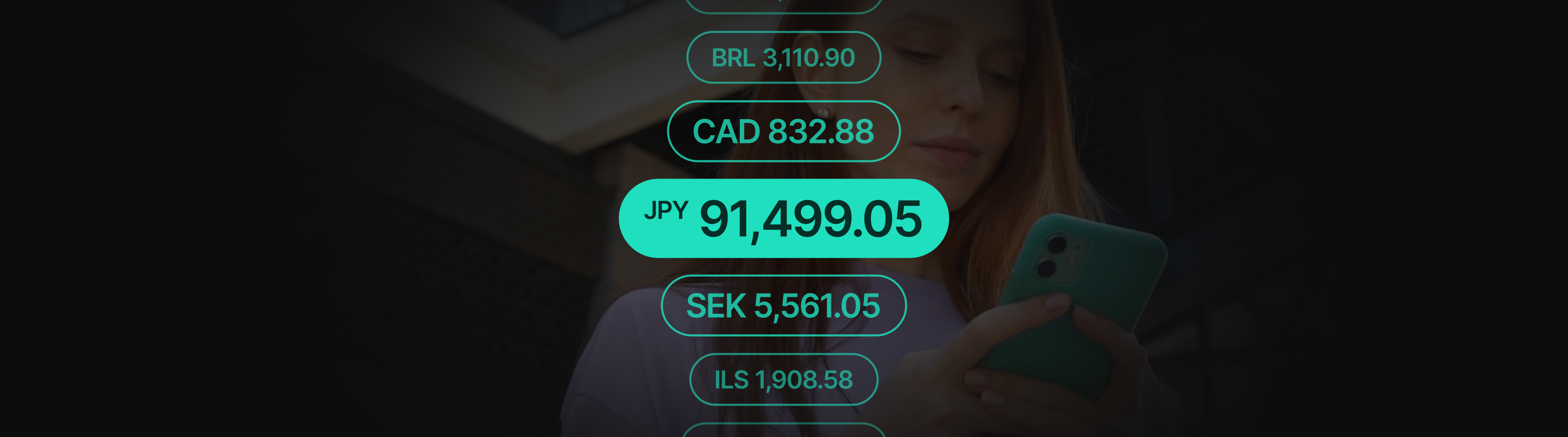

- Dynamic Currency Conversion: Present prices in the customer's local currency and convert into supported currencies live in the checkout page. This feature enhances transparency and customer trust, potentially boosting conversion rates for international transactions. Read more.

Selecting the right payment methods for your checkout is a crucial step in optimizing your online business, especially for industries like iGaming and retail trading that rely heavily on customer deposits. By understanding regional preferences, offering a diverse range of payment options, and implementing advanced payment solutions, you can significantly improve your conversion rates and gain a competitive edge.

Get in touch with Praxis Tech to optimize your payments strategy.