How often do you think of fraud? Unfortunately, probably not enough. Global online payment fraud is increasing and PwC’s most recent Global Economic Crime and Fraud Survey found that 51% of organizations have experienced fraud in the last two years. That’s the highest level in its 20 years of research.

We keep reading how AI will soon become the intelligent all-knowing best friend you never knew you needed, able to translate your conversations in real-time, read your facial expressions, and even be an alternative pair of eyes, but what about acting as your security shield against bad actors?

This week’s edition of The Praxis Times focuses on how the latest advancements in Generative AI and Machine Learning (ML) are increasingly being adopted by payment companies to protect merchants and their customers from fraud.

Many of these tools have long been embedded in the payment infrastructure your company uses to shield itself from risk, though to paint a clearer picture of how this works in practice, we first need to understand the current state of protections.

Rules, Algorithms, and a Human Touch

It’s true that payment companies have been using some form of AI systems for a very long time. In fact, Visa claims to have been the first back in 1993 though there are many different types of terms and applications in fraud detection, so let’s quickly define:

- Rules-Based Systems: These are the veterans of fraud prevention and use predefined rules or pattern sequences to flag suspicious transactions. For example, a system might flag any transaction over $10,000 for review.

- Machine Deep Learning Systems: Just over a decade old and getting better fast, these are increasingly being adopted. Using computer code to process vast datasets and identify subtle fraud patterns, these systems intelligently adapt to new fraud techniques in real-time.

- Manual Reviews: The human element remains essential, for now. When the algorithms raise a red flag, skilled analysts step in to investigate and take action.

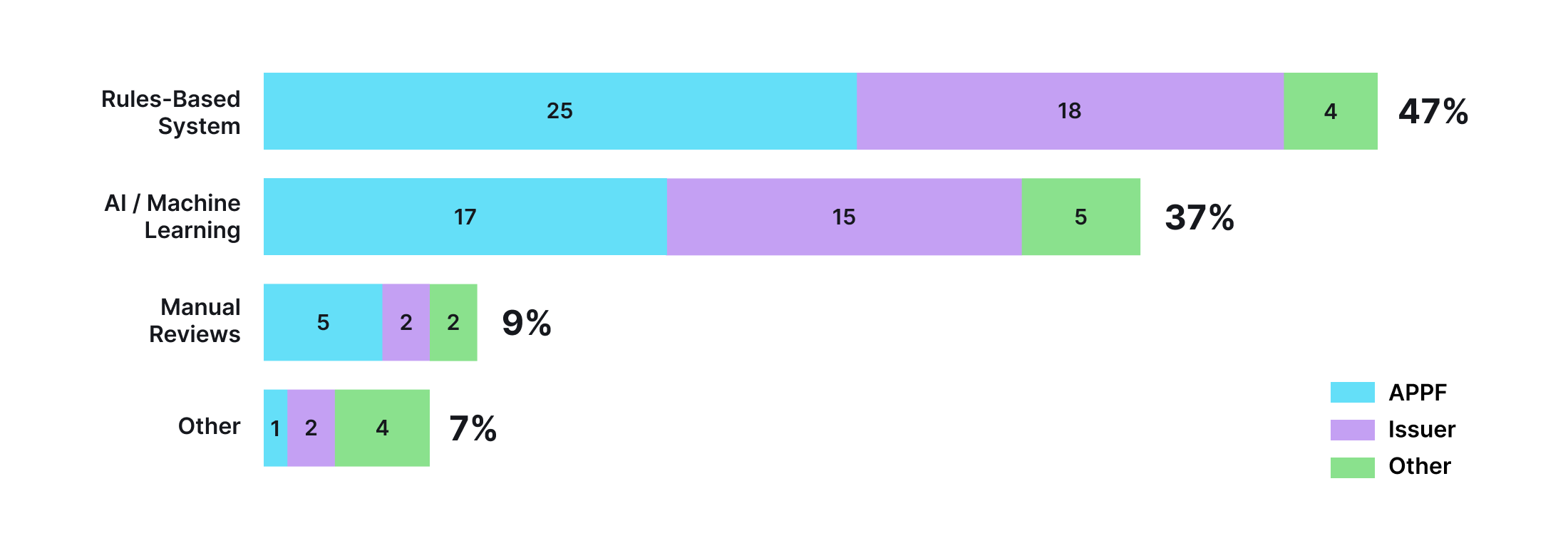

Mastercard recently surveyed a large number of Acquirers, Payment Service Providers, and Payment Facilitators (APPF), as well as Issuers and other intermediaries in payments, and found that while the Rules-Based systems remain king, 93% plan to invest in more AI over the next 2-5 years.

Source: Mastercard AI Perspectives - Transaction Fraud Report 2023

So many are investing in new ML systems as they are better able to scan vast amounts of historical transaction data and spot suspicious patterns, often before allowing the payment to go through in the first place.

This is how Visa’s CyberSource Solution prevented an estimated $33 billion worth of potential fraud in 2023, intelligently recognizing suspicious patterns by being plugged into the many billions of transactions that went through Visa’s card network last year.

Others, like Mastercard’s AI-network, use ML to track funds across suspected mule accounts and tell banks when to take action, saving TSB Bank in the UK almost £100 million so far alone. These use cases are sure to keep growing in the future.

Fighting APP Fraud with Generative AI

Just as Machine Learning systems are getting better at detecting fraud in data flows, and payment infrastructure, tokenization, and verification requirements make it harder for frauders to infiltrate secure systems, scammers are instead reaching out to victims directly, via phone, SMS, social media, and email, and convincing them to transfer the funds themselves.

This is called Authorized Push Payment (APP) fraud and, unfortunately, it’s one of the largest methods of payment fraud, with industry expectations that it will climb to $5.25 billion across the US, UK, and India by 2026.

Often posing as genuine banking representatives, criminals use social engineering methods to trick victims into sending money to their accounts.

But how can you stop someone from sending money from their account?

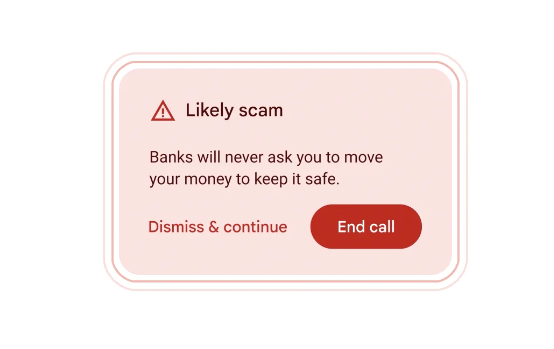

Just this week, Google revealed a Large-Language Model (LLM) that will soon be on your Android phone, which listens to your telephone calls and warns the user if the person on the other line is likely attempting to defraud them.

Image: Google

Handling all this data locally on the phone, and not sharing it with Google servers at all, this on-device Gemini Nano will be able to reduce APP scams by looking for common scammer conversation patterns and issuing real-time warnings.

This is fantastic, but only if you’re comfortable with this nano AI listening to all your phone calls.

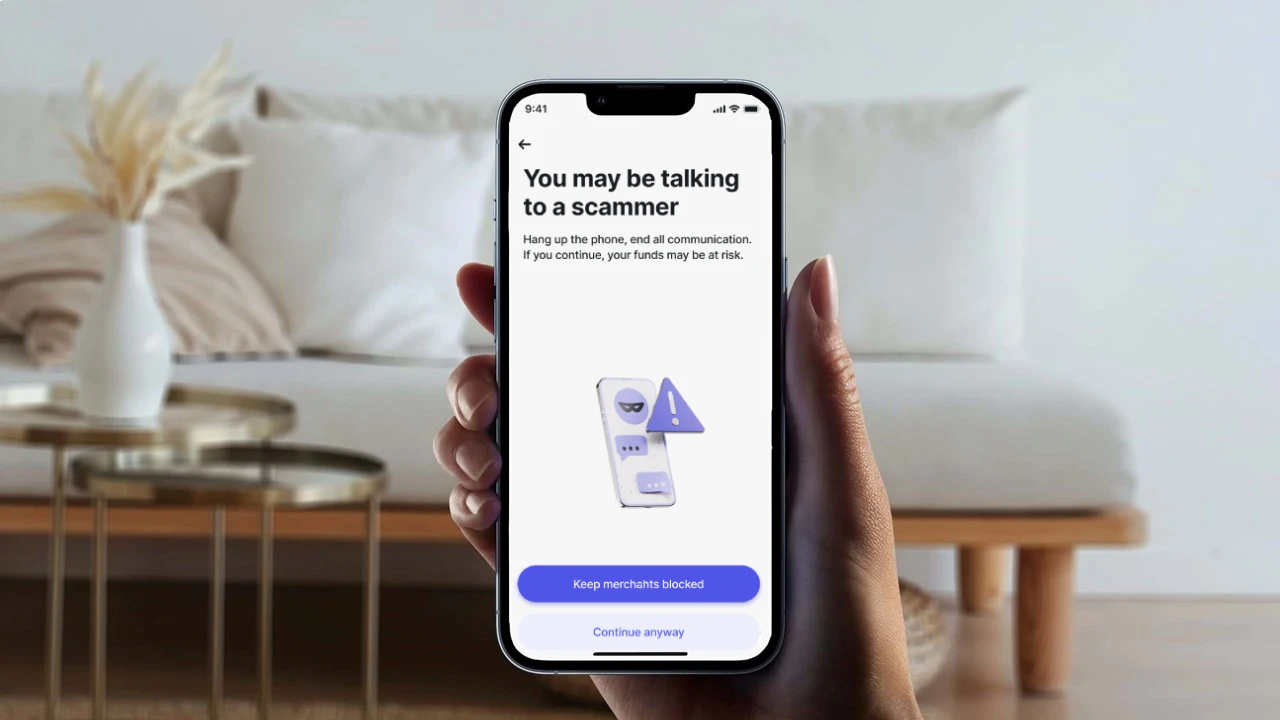

Revolut also recently launched an AI feature to better protect its customers from APP scams and break what it calls the “scammers spell” by using ML too. If it detects a high likelihood someone is about to make a payment as part of a scam, they’ll be prompted with scam education stories to make customers think twice.

Image: Revolut

The company says it’s observed a 30% reduction in fraud losses since initial testing and expects to see a significant decrease in APP fraud among its 35 million worldwide customers.

The proliferation of generative AI tools is slowly but surely making its way across the payment industry, with Visa announcing a new AI-powered fraud solution last week to combat card-not-present (CNP) transaction fraud by better identifying enumeration attacks, where scammers attempt to guess card information.

The Bottom Line - Why AI Matters in Payments

Of course, this tech is also being used in other fields within the payments space, from automating routine payment tasks to reconciling payments across data sets, and identifying if someone is attempting invoice fraud by checking against duplicate invoices within your payment infrastructure.

To utilize the best of these new developments, merchants need to incorporate secure infrastructure that protects their customers’ sensitive payment information from falling into the wrong hands and to better protect themselves from chargeback fraud.

Get in touch with Praxis Tech to learn more about how our Payment Orchestration Platform can protect your business from malicious actors.