This article is all about giving credit where credit is due. And Amazon deserves credit for removing the single biggest friction point for all online payments - the checkout process itself.

The One-Click Payment is one of those groundbreaking innovations that often doesn’t get enough attention. Ever since it was invented and patented by Amazon, it has made it easier for customers to make payments online and quicker for merchants to convert would-be customers to loyal customers.

The concept is elegantly simple - store customers’ billing details to enable subsequent purchases with a single click.

Today, whether it’s clicking ‘Pay Now’ for a quick purchase, making a ‘Margin Call’ in a trading app, or choosing to ‘Top-Up’ a balance when playing online Blackjack without leaving the game, one-click payments have become synonymous with speed and convenience.

This article talks about the history of One-Click Payments, explains how it works for interested online merchants who are considering upping their payment game, and lists the many benefits associated with this payment functionality, such as fewer abandoned transactions.

The Genesis of One-Click Payments

Amazon’s 1999 patent of 1-Click purchasing marked a huge moment for online payments, back at a time when there was little trust in sharing your card payment details with faceless online brands. So much so, a month after it launched, Amazon’s book-store competitor Barnes and Noble released a similar feature that led to a lawsuit settlement in 2002.

Steve Jobs was famously so taken aback by how cool it was to buy things with one click that in an Oral History Wired Magazine recites he called up Amazon and said, “Hey, this is Steve Jobs,” and paid a million dollars to license the patent for Apple's new iTunes music store.

By providing a quick and simple way to complete transactions, One-Click Payments encourage impulse purchases and significantly reduce cart abandonment, which is something that plagued online sales in 2000 and continues to today in 2024.

"We need to make it so the customer can order products with the least amount of effort. They should be able to click on one thing, and it’s done." - Jeff Bezos, 1997

A not-so-technical explanation of how this works

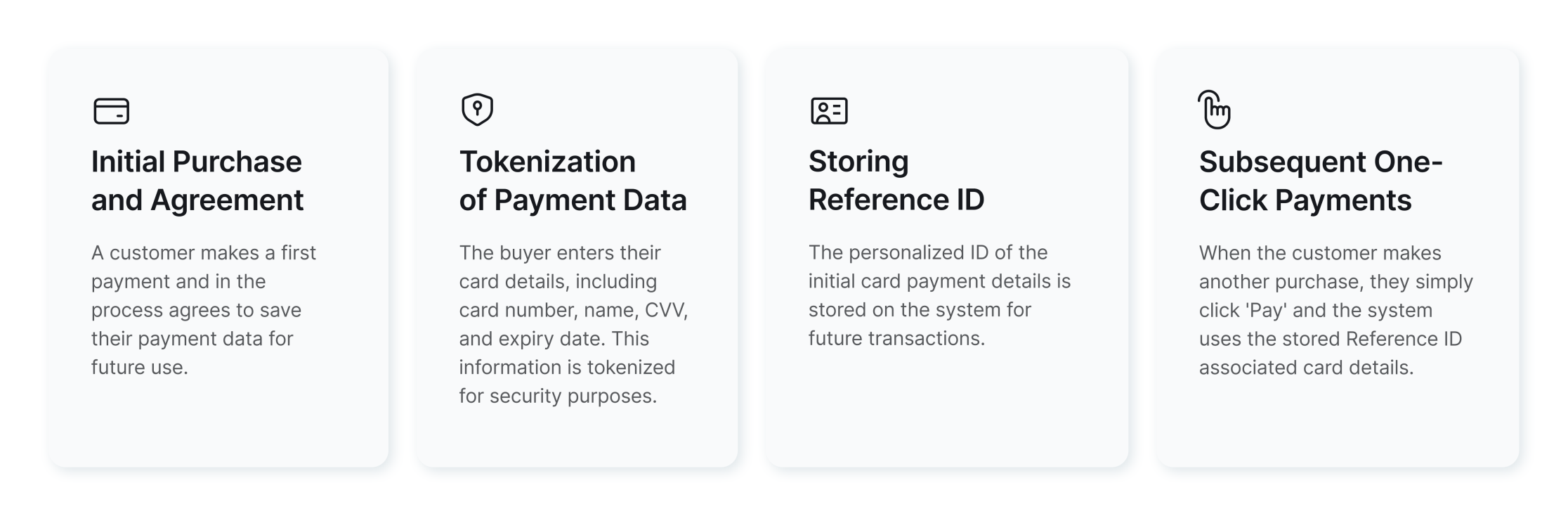

Fundamentally, after the first checkout experience (which can be branded and enhanced to be as frictionless as possible), a customer’s card payment details are securely stored, encrypted, and saved as a Reference ID associated with their account, only to be used again when the customer clicks ‘pay now’ for a second, third, and fourth time thereafter.

For the customer, this means clicking the ‘Save payment details’ checkbox, whereas for the merchant this consists of incorporating card-on-file tokenization and storing card details in a PCI-DSS compliant way (or using a certified third-party to handle this and all the other technicalities for them).

The indispensable tool for online merchants

Twenty-five years since its invention, and seven years after Amazon’s patent expired in September 2017, One-Click Payments remain high in demand for a diverse range of online merchants, from e-commerce platforms and iGaming sites to brokers managing quick financial transactions, where seconds and milliseconds count.

With 18% of customers abandoning their payments due to lengthy checkout experiences, it’s a must-have tool for businesses.

For online merchants looking to incorporate this functionality within their existing payment operations, get in touch with Praxis Tech to learn how our Merchant Initiated Transactions (MIT) suite of features can enable One-Click, Recurring Subscription, and Automatic Top-Up Payments.